AUD/USD Weekly Forecast: Fed’s 2025 Outlook Sparks Greenback…

- Enterprise exercise within the US rose, supported by the service sector.

- The financial system expanded by three.1% within the fourth quarter.

- The Fed reduce charges however projected solely 50 bps of cuts in 2025.

The AUD/USD weekly forecast suggests renewed downward stress because the greenback rallies on the outlook of fewer Fed price cuts in 2025.

Ups and downs of AUD/USD

The AUD/USD pair had a bearish week because the greenback soared on upbeat financial knowledge and a drop in Fed price reduce bets. Information through the week revealed that enterprise exercise within the US rose, supported by the service sector. On the identical time, retail gross sales jumped greater than anticipated in November. In the meantime, the financial system expanded by three.1% within the fourth quarter in comparison with forecasts of two.eight%.

Nevertheless, the first catalyst got here when the Fed reduce charges however projected solely 50 bps of cuts in 2025. This boosted the buck and sunk the Aussie.

Subsequent week’s key occasions for AUD/USD

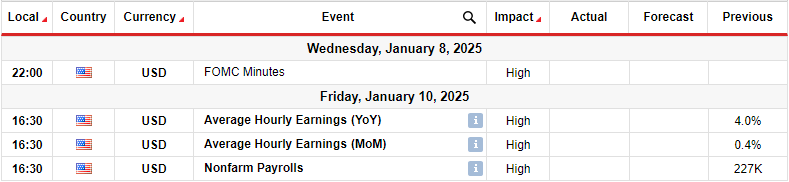

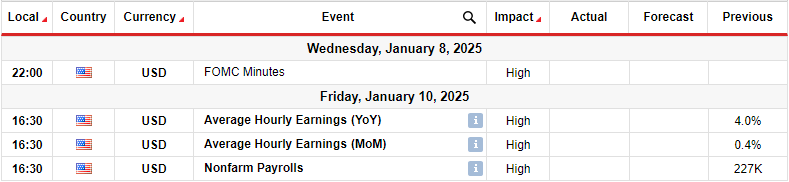

The following essential week will are available 2025 when the US will launch its first main report on month-to-month employment. On the identical time, traders will deal with the FOMC assembly minutes.

The US nonfarm payroll report for December will present the state of the labor market going into the brand new 12 months. A sturdy report will help the Fed’s new outlook for a gradual easing tempo in 2025. However, a downbeat report will present cracks within the labor market, rising Fed price reduce expectations.

In the meantime, the FOMC minutes will present what went into the December assembly. Furthermore, it’d include clues in regards to the future.

AUD/USD weekly technical forecast: Bears put together to breach the zero.6202 help

On the technical facet, the AUD/USD value has made a brand new low close to the zero.6202 help degree. This transfer has pushed the worth effectively under the 22-SMA, an indication that bears have a powerful lead. On the identical time, the RSI trades within the oversold area, exhibiting stable bearish momentum.

–Are you curious about studying extra about Canadian foreign exchange brokers? Examine our detailed guide-

After a corrective bullish transfer, bears took management by breaking under the 22-SMA and the zero.6675 degree to make a decrease low. Since then, the worth has maintained a downward trajectory, making decrease lows. The RSI has additionally maintained its place in bearish territory. Furthermore, it has not made a bullish divergence, indicating that bears are nonetheless keen about decrease costs. Subsequently, the worth will seemingly breach the zero.6202 help within the new 12 months to make new lows.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you may afford to take the excessive threat of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!