AUD/USD Weekly Forecast: RBA-Fed Divergence Boosts Promote-off…

- The US economic system added a bigger-than-expected variety of jobs in December.

- US unemployment fell, indicating a resilient labor market.

- Core inflation in Australia eased, boosting RBA fee lower bets.

The AUD/USD weekly forecast factors south amid rising RBA fee lower bets and decrease expectations for Fed fee cuts.

Ups and downs of AUD/USD

This week, the Aussie collapsed because the greenback soared on upbeat information and RBA fee lower bets jumped. The US economic system confirmed continued resilience, with experiences on service sector enterprise exercise, jobs and unemployment claims beating forecasts. Furthermore, the economic system added a bigger-than-expected variety of jobs in December, with the unemployment fee dropping. Because of this, Fed fee lower bets fell.

-Are you on the lookout for ideas for foreign currency trading? Try the details-

However, Australia’s inflation figures final week revealed a slowdown in underlying value pressures. Consequently, fee lower bets for a Feb RBA fee lower elevated, weakening the Aussie.

Subsequent week’s key occasions for AUD/USD

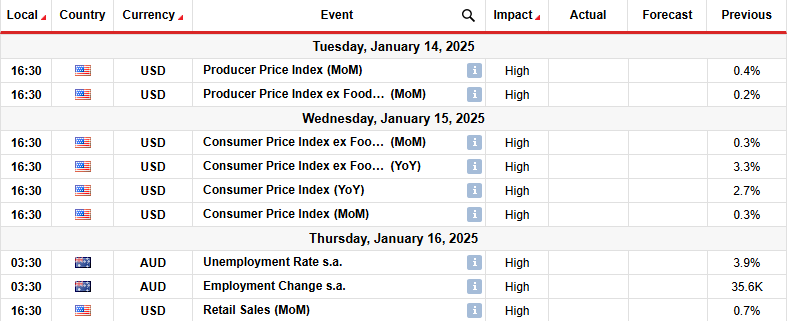

Subsequent week, merchants will scrutinize inflation and retail gross sales figures from the US. In the meantime, Australia will launch its month-to-month employment figures. The Fed has forecasted solely two fee cuts this yr as a result of a resilient economic system.

On the identical time, inflation has stalled its decline, resulting in policymakers shedding confidence. If the US releases one other upbeat report, markets may decrease expectations to only one fee lower this yr. However, a downbeat report will improve rate-cut bets, weighing on the greenback.

In the meantime, market individuals have elevated bets for an RBA fee lower in February. A downbeat employment report will improve these bets, hurting the Aussie. However, if employment jumps, rate-cut bets will fall.

AUD/USD weekly technical forecast: Bears breach 1.272 Fib extension

On the technical facet, the AUD/USD value has breached a major help comprising the zero.6200 help and the 1.272 Fib extension stage. The worth has maintained a strong downtrend, buying and selling beneath the 22-SMA resistance. In the meantime, the RSI has maintained its place in bearish territory.

-Are you on the lookout for crypto exchanges? Examine our detailed guide-

For the reason that bearish bias is robust, there’s a excessive probability AUD/USD will goal the 1.618 Fib extension stage subsequent week. The downtrend will proceed if the worth stays beneath the 22-SMA and the RSI beneath 50.

However, if the worth fails to carry its place beneath the zero.6200 stage, it would bounce again to retest the SMA or the zero.6400 key stage as resistance. A break above would sign a bullish reversal. However, if bears stay within the lead, the worth will bounce decrease to proceed the downtrend.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to think about whether or not you’ll be able to afford to take the excessive danger of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!