Gold (XAU) Silver (XAG) Every day Forecast: Commerce Tensions and Charge Reduce Hypothesis Gasoline Demand…

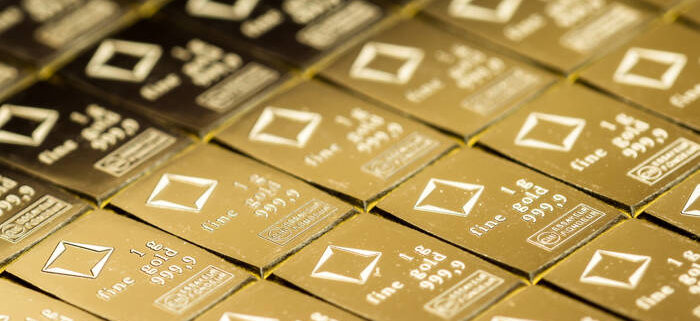

The safe-haven asset stays in demand as market members brace for potential disruptions in world commerce.

Fed Charge Reduce Expectations Help Gold’s Momentum

Market hypothesis that the Federal Reserve may minimize rates of interest twice this 12 months has additional fueled gold’s bullish momentum. Analysts recommend that easing inflationary pressures within the U.S. have raised the probability of financial coverage changes, making gold a gorgeous hedge in opposition to potential financial uncertainty.

“Gold stays well-positioned as traders anticipate charge cuts to help financial development,” stated a senior market strategist at a number one funding agency.

Regardless of a modest restoration in U.S. Treasury yields, which helped the U.S. Greenback (USD) rebound from a two-week low, gold’s upward trajectory has remained largely intact. The 10-year U.S. Treasury yield edged increased to four.12%, offering some headwinds to additional gold good points.

Silver Faces Stress Amid Stronger Greenback

In distinction, silver (XAG/USD) struggled to take care of its footing, buying and selling round $30.91 after hitting an intra-day low of $30.73. The modest restoration within the U.S. greenback, coupled with shifting expectations across the Fed’s charge choices, has exerted downward stress on silver costs.

Analysts level to silver’s industrial demand publicity, which makes it extra inclined to financial slowdowns in comparison with gold.

Leave a Reply

Want to join the discussion?Feel free to contribute!