EUR/USD Weekly Forecast: Downbeat EU Knowledge Caps Features…

- A set of PMI figures revealed a major drop in enterprise exercise within the Eurozone.

- US unemployment claims dropped, indicating tight labor market situations.

- US inflation elevated by zero.1% in comparison with estimates of a zero.2% improve.

The EUR/USD weekly forecast reveals a impartial bias because the Eurozone financial system weakens and Fed price reduce bets soar.

Ups and downs of EUR/USD

The EUR/USD fluctuated this week and ended practically flat amid a mixture of US and Eurozone knowledge. When the week started, a set of PMI figures revealed a major drop in enterprise exercise within the Eurozone. This raised strain on the ECB to proceed reducing rates of interest, weighing on the euro.

–Are you interested by studying extra about Canada foreign exchange brokers? Verify our detailed guide-

In the meantime, US enterprise exercise held regular because the financial system remained resilient regardless of excessive rates of interest. Furthermore, unemployment claims dropped, indicating tight labor market situations.

Nonetheless, the greenback weakened on Friday after the core PCE report revealed cooler-than-expected inflation. Value pressures elevated by zero.1% in comparison with estimates of a zero.2% improve, elevating the probability of one other huge price reduce in November.

Subsequent week’s key occasions for EUR/USD

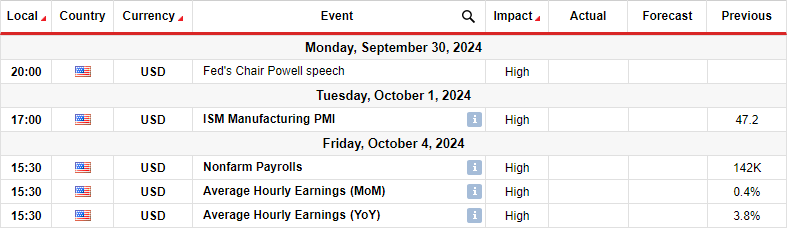

Subsequent week, market individuals will take note of key US studies, together with manufacturing enterprise exercise and the nonfarm payrolls report. Furthermore, Federal Reserve Chair Jerome Powell will converse on Monday.

The main focus for the week would be the month-to-month employment report. Notably, the Fed is paying shut consideration to the labor marketplace for any weak spot. On the final assembly, the central financial institution reduce charges by 50-bps, saying it was meant to maintain the unemployment price low. Subsequently, merchants will watch job development and unemployment in September for clues on the Fed’s subsequent coverage transfer. Economists count on the financial system so as to add 144,000 jobs in September.

EUR/USD weekly technical forecast: Bulls present weak spot on the 1.1175 resistance

On the technical facet, the EUR/USD worth has revisited the 1.1175 resistance stage, the place it has paused. On the similar time, the RSI has made a bearish divergence, indicating fading bullish momentum. The worth has remained in a bullish development, making greater highs and lows. Nonetheless, the RSI confirmed weak spot in the latest transfer.

–Are you interested by studying extra about social buying and selling platforms? Verify our detailed guide-

Subsequently, there’s a likelihood the worth would possibly reverse to problem the 22-SMA and the bullish trendline. A break under these ranges would clear the trail to the 1.1000 help stage. Right here, bears will struggle to interrupt the earlier low and begin making decrease highs and lows. Such a transfer would verify the beginning of a bearish development.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you may afford to take the excessive danger of dropping your cash

Leave a Reply

Want to join the discussion?Feel free to contribute!