USD/JPY Weekly Forecast: Yen Soars as BoJ Charge Hike Looms…

- The yen rallied after Shigeru Ishiba received Japan’s election.

- Ishiba helps the current Financial institution of Japan coverage strikes.

- The greenback fell on account of softer-than-expected inflation numbers.

The USD/JPY weekly forecast leans South on account of an elevated probability of extra price hikes in Japan and cuts within the US.

Ups and downs of USD/JPY

The USD/JPY pair had a bearish week because the yen rallied after Japan’s election. In the meantime, the greenback fluctuated on account of combined financial information. The tight election for the Prime Minister seat in Japan ended with a win for former protection minister Shigeru Ishiba. The yen rallied after the end result as a result of Ishiba helps the current Financial institution of Japan coverage strikes. Due to this fact, analysts imagine there might be extra price hikes beneath his management.

–Are you curious about studying extra about Canada foreign exchange brokers? Examine our detailed guide-

In the meantime, the greenback initially had a strong begin to the week when information confirmed regular enterprise exercise and a decline in jobless claims. Nevertheless, it ended weak on account of softer-than-expected inflation numbers.

Subsequent week’s key occasions for USD/JPY

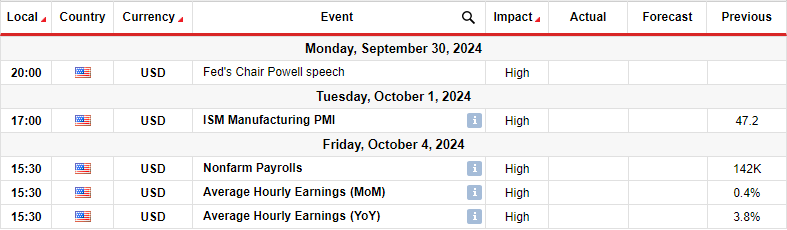

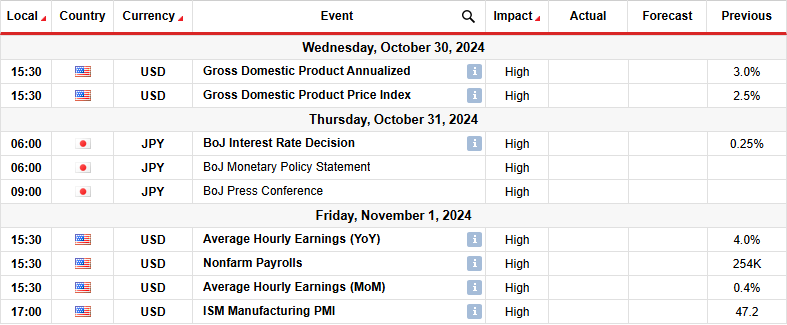

Subsequent week, all eyes might be on US financial information, with none anticipated from Japan. The US will launch figures on manufacturing enterprise exercise and employment. Moreover, a speech from Fed Chair Powell would possibly comprise clues about future price cuts.

After the current FOMC coverage assembly, policymakers have taken a extra dovish tone, implying extra price cuts sooner or later. Due to this fact, there’s a probability Powell will proceed with this pattern, placing downward stress on the US greenback.

Moreover, the month-to-month jobs report will present the state of job development and unemployment. Economists anticipate 144,000 extra jobs within the economic system, a slight improve from the earlier studying. In the meantime, the unemployment price would possibly maintain regular at four.2%.

USD/JPY weekly technical forecast: Bears pierce the 22-SMA

On the technical aspect, the USD/JPY worth is on a bearish pattern as the value trades beneath the 22-SMA, with the RSI in bearish territory. Nevertheless, worth motion exhibits weak spot within the downtrend. The value trades close to the SMA and has punctured the road a number of occasions. It is a signal that bulls are getting stronger.

–Are you curious about studying extra about social buying and selling platforms? Examine our detailed guide-

In the meantime, bears are weakening, as seen within the RSI, which has made a bullish divergence. Due to this fact, if the value fails to interrupt beneath the 141.01 assist within the coming week, it’d break above the SMA. Such a break would point out a shift in sentiment, permitting the value to climb to the 149.57 resistance degree.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to think about whether or not you’ll be able to afford to take the excessive threat of dropping your cash

Leave a Reply

Want to join the discussion?Feel free to contribute!