USD/CAD Weekly Forecast: Greenback Rebounds on Auto Tariff Plan…

- The USD/CAD weekly forecast reveals a slight rebound within the greenback.

- Trump is able to implement extra tariffs, together with on vehicles.

- Canadian knowledge revealed stable underlying inflation and upbeat gross sales.

The USD/CAD weekly forecast signifies a modest rebound of the greenback following Trump’s proposal for car tariffs.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week however remained close to final week’s lows because the greenback remained fragile. On the similar time, knowledge from Canada eased strain on the Financial institution of Canada to decrease borrowing prices.

–Are you to study extra about day buying and selling brokers? Examine our detailed guide-

Information that Trump will quickly meet China’s president raised hopes for a commerce deal between the 2 international locations, boosting danger sentiment. Nonetheless, Trump is able to implement extra tariffs, together with these on vehicles, to help the greenback.

In the meantime, in Canada, knowledge revealed stable underlying inflation and upbeat gross sales. Consequently, BoC charge lower bets fell.

Subsequent week’s key occasions for USD/CAD

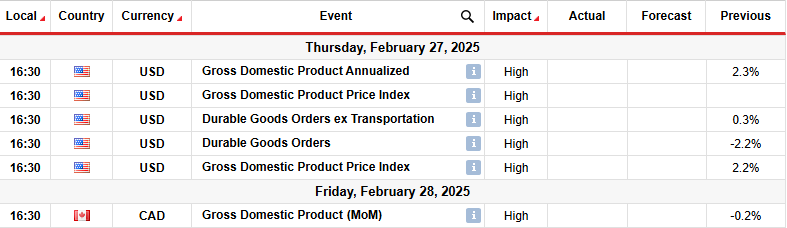

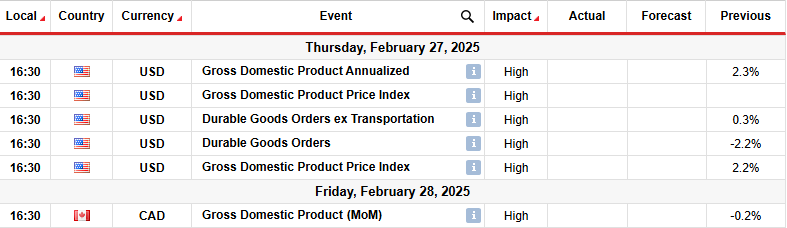

Merchants will watch key experiences from the US, together with gross home product and core sturdy items. In the meantime, Canada will launch its GDP report.

The US GDP report will present the state of the economic system and information the Ate up future coverage strikes. An even bigger-than-expected enlargement will present strong progress, supporting the Fed’s present stance of warning. The greenback would rally on this case, pushing USD/CAD larger. Then again, if enlargement is weak, the Fed may really feel extra strain to decrease borrowing prices.

The identical applies to Canada’s GDP, which is able to information the outlook for Financial institution of Canada charge cuts.

USD/CAD weekly technical forecast: Bears eye the 1.3802 help

On the technical aspect, the USD/CAD worth has reversed and located its footing under the 22-SMA. On the similar time, the RSI trades under 50, indicating sturdy bearish momentum. The earlier bullish development reversed after the RSI made a bearish divergence, indicating weak momentum. On the similar time, the worth made a bearish engulfing candle, resulting in a break under the 22-SMA and the 1.4300 help stage.

-Are you searching for one of the best CFD dealer? Examine our detailed guide-

Nonetheless, the decline has paused, and the worth may retest the 22-SMA and the 1.4300 stage as resistance. If it holds agency and the worth continues decrease, it’s going to affirm a brand new bearish development. On this case, bears will goal the 1.3802 help stage.

Nonetheless, if bulls handle to push the worth again above the SMA, it’d enter a interval of consolidation or resume the bullish development.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you possibly can afford to take the excessive danger of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!