AUD/USD Weekly Forecast: Strong Jobs Information Boosts Aussie…

- The AUD/USD weekly forecast exhibits continued power in Australia’s labor market.

- The Reserve Financial institution of Australia carried out its first charge lower this week.

- Information revealed a pointy decline in enterprise exercise within the US service sector.

This AUD/USD weekly forecast highlights the numerous impression of Australia’s sturdy labor market on the appreciation of the Australian greenback.

Ups and downs of AUD/USD

The AUD/USD pair had a bullish week regardless of an RBA charge lower on Tuesday. The power got here from an upbeat employment report from Australia and a weak greenback.

–Are you to study extra about day buying and selling brokers? Verify our detailed guide-

The Reserve Financial institution of Australia carried out its first charge lower this week however remained cautious on account of labor market power. Information on Thursday revealed an sudden soar in job progress in Australia. In the meantime, the US greenback was fragile amid hopes for a commerce deal between the US and China. On the similar time, information on Friday revealed a pointy decline in enterprise exercise within the US service sector.

Subsequent week’s key occasions for AUD/USD

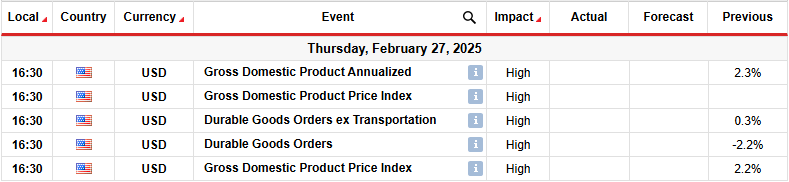

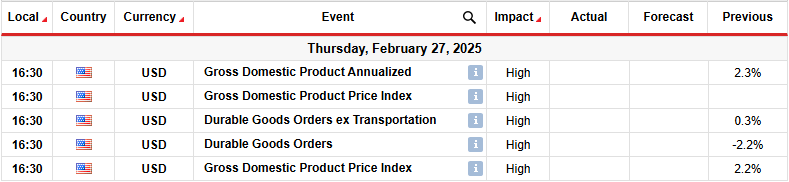

Subsequent week, market contributors will deal with US GDP and core sturdy items information. The US economic system has proven resilience in 2025, with just a few weak spots, equivalent to retail gross sales. Because of this, the outlook for the Fed stays principally hawkish, with market contributors anticipating solely two cuts this 12 months.

Upbeat GDP information would possibly additional decrease rate-cut expectations, boosting the greenback. However, if financial progress disappoints, charge lower expectations will improve, hurting the buck

AUD/USD weekly technical forecast: Bulls face the zero.382 Fib retracement degree

On the technical facet, the AUD/USD worth trades above the 22-SMA with the RSI above 50, supporting a bullish bias. The development just lately reversed when bears paused on the zero.6100 assist degree. Bears steadily misplaced momentum as the worth approached this degree, permitting bulls to emerge and break above the 22-SMA. On the similar time, the RSI broke above 50, indicating stronger bullish momentum.

Nevertheless, bulls face a powerful resistance zone comprising the zero.382 Fib retracement and the zero.6401 key degree. If the bulls are sturdy, they may break above this zone to make new highs. Nevertheless, the worth would possibly pull again to retest the SMA earlier than climbing greater.

However, if the zone holds agency, bears would possibly overpower bulls to interrupt beneath the SMA and retest the zero.6100 assist. A break beneath this degree would verify a continuation of the earlier downtrend.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you’ll be able to afford to take the excessive threat of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!