AUD/USD Weekly Forecast: Sturdy Information Boosts Greenback…

- US unemployment claims fell greater than anticipated.

- Enterprise exercise within the US manufacturing and providers sectors improved.

- Market members will take note of Australia’s inflation knowledge.

The AUD/USD weekly forecast signifies continued resilience within the US economic system, protecting the greenback agency in opposition to the Australian greenback.

Ups and downs of AUD/USD

The AUD/USD pair ended the week down because the greenback rose after upbeat US financial knowledge. On the identical time, Center East tensions elevated demand for the dollar. The US launched two important stories on jobless claims and enterprise exercise.

–Are you curious about studying extra about British Commerce Platform Overview? Verify our detailed guide-

Unemployment claims fell greater than anticipated, indicating tight labor market situations. Consequently, fee reduce expectations eased, boosting the greenback. A separate report revealed that enterprise exercise within the manufacturing and providers sectors improved as demand elevated. On the identical time, the battle between Israel and Hezbollah escalated, sending merchants to haven belongings just like the greenback.

Subsequent week’s key occasions for AUD/USD

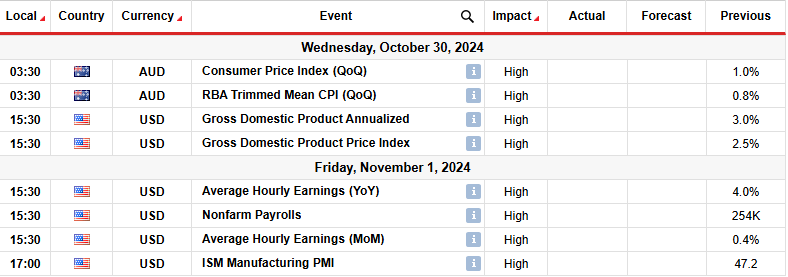

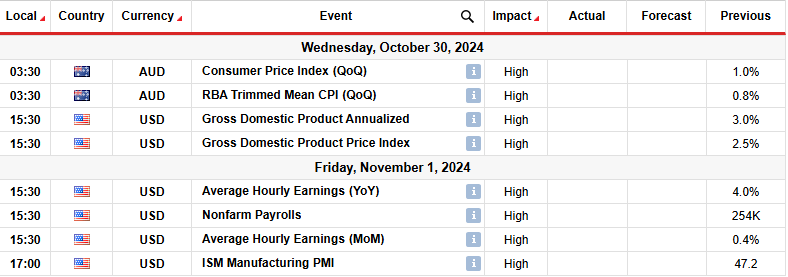

Within the coming week, market members will take note of Australia’s inflation knowledge. In the meantime, the US will launch knowledge on GDP manufacturing PMI and nonfarm payrolls. Australia’s CPI numbers will considerably form the outlook for the Reserve Financial institution of Australia fee cuts. If inflation surprises to the upside, the Aussie will rally as rate-cut expectations fall.

Alternatively, the nonfarm payrolls report can be among the many final important stories earlier than the Fed’s November assembly. An upbeat report will doubtless decrease the chance of a fee reduce. Alternatively, an sudden decline in job development might deliver again bets for a super-sized fee reduce.

AUD/USD weekly technical forecast: zero.6650 break confirms new downtrend

On the technical facet, the AUD/USD worth has reversed to the draw back on the day by day chart. Bears took management when the worth broke beneath the 22-SMA assist line. Furthermore, the worth broke beneath the zero.6650 assist to make a decrease low, confirming the reversal. In the meantime, the RSI has dipped into bearish territory and trades close to the oversold area, suggesting stable momentum.

–Are you to be taught extra about foreign exchange indicators? Verify our detailed guide-

Moreover, AUD/USD has damaged beneath the zero.5 Fib retracement stage, signaling a major pullback or reversal. The stable bearish bias means the worth will doubtless retest the zero.6501 subsequent week. Moreover, the worth may make the primary decrease excessive, additional confirming the brand new downtrend. This bias will stay so long as the worth stays beneath the 22-SMA and the RSI trades beneath 50.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you’ll be able to afford to take the excessive threat of shedding your cash

Leave a Reply

Want to join the discussion?Feel free to contribute!