USD/JPY Weekly Forecast: Fed-BoJ Divergence Triggers Shopping for…

- US jobless claims fell greater than anticipated, indicating stable demand for labor.

- US PMI information confirmed development within the manufacturing and providers sectors.

- Tokyo CPI numbers confirmed inflation easing beneath the central financial institution’s 2% goal.

The USD/JPY weekly forecast helps additional upside as markets anticipate a gradual Fed rate-cutting cycle and a much less hawkish BoJ.

Ups and downs of USD/JPY

The USD/JPY pair had a bullish week as market individuals centered on the US financial system’s resilience. On the identical time, inflation figures in Japan eased, reducing expectations for BoJ fee hikes.

–Are you curious about studying extra about British Commerce Platform Evaluation? Test our detailed guide-

US information through the week confirmed that jobless claims fell greater than anticipated, indicating stable demand for labor. In the meantime, PMI information confirmed development within the manufacturing and providers sectors. Consequently, there’s much less strain on the Fed to decrease borrowing prices.

In Japan, Tokyo CPI numbers confirmed inflation easing beneath the central financial institution’s 2% goal, complicating the outlook for BoJ fee hikes and weighing on the yen.

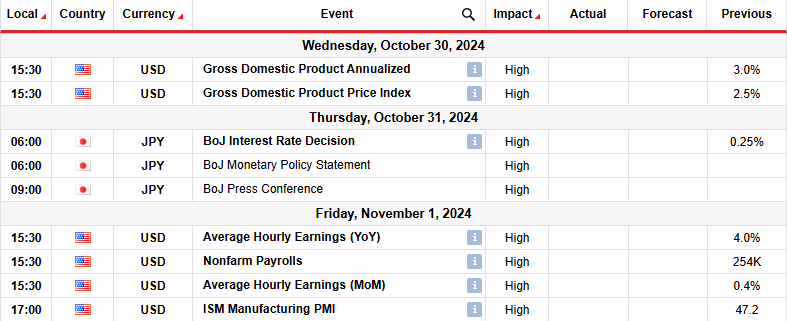

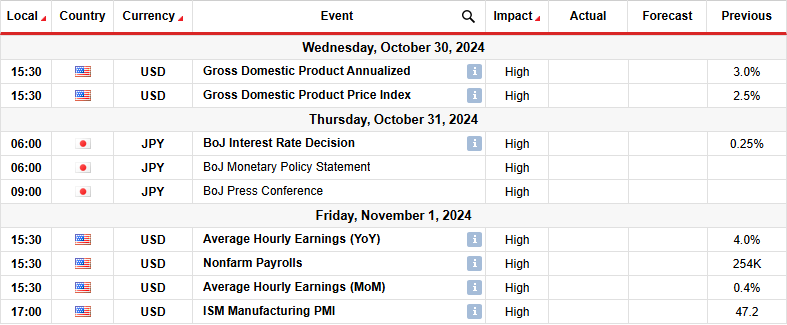

Subsequent week’s key occasions for USD/JPY

Subsequent week, the Financial institution of Japan will maintain its coverage assembly and certain maintain charges unchanged. In the meantime, the US will launch information on GDP, month-to-month employment and manufacturing PMI. The outlook for fee hikes in Japan has shifted with the brand new Prime Minister and incoming financial information. Ishiba famous that the financial system was not prepared for extra fee hikes. In the meantime, inflation information has proven weak consumption, additional difficult the outlook.

Then again, the US financial system has remained resilient with sturdy demand. Due to this fact, there’s a excessive probability the NFP report will present sturdy job development, decreasing bets for a November Fed fee lower.

USD/JPY weekly technical forecast: zero.618 Fib resistance poses problem

On the technical facet, the USD/JPY worth has began a brand new bullish pattern that has paused close to the 153.00 resistance degree. The bullish bias is powerful for the reason that worth has traded effectively above the 22-SMA since bulls took management. On the identical time, the RSI has stayed close to the overbought area, suggesting stable bullish momentum.

–Are you to study extra about foreign exchange indicators? Test our detailed guide-

Nonetheless, the brand new bullish pattern is dealing with a stable resistance zone comprising the zero.618 Fib retracement degree and the 153.00 psychological degree. Due to this fact, the worth would possibly pause at this degree earlier than both breaking above or pulling again to retest the SMA assist. However, so long as USD/JPY stays above the SMA, it would ultimately break the resistance zone and retest the 158.04 resistance degree.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to think about whether or not you possibly can afford to take the excessive danger of dropping your cash

Leave a Reply

Want to join the discussion?Feel free to contribute!