AUD/USD Weekly Forecast: Uncertainty Forward of Election Week…

- Australia’s inflation eased from 2.7% to 2.1% yearly.

- The US financial system added 12,000 jobs, effectively under the forecast of 106,000.

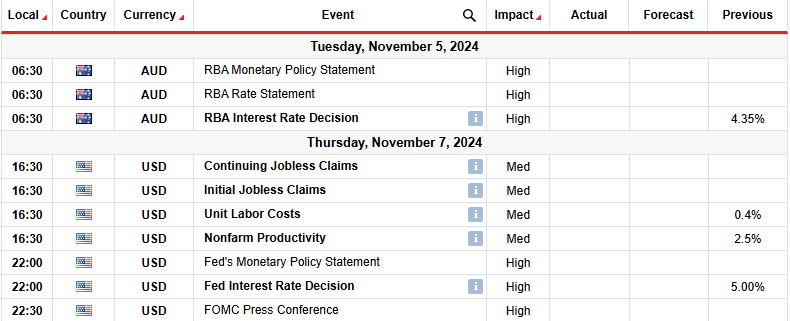

- Merchants will watch the RBA and Fed coverage conferences.

The AUD/USD weekly forecast signifies uncertainty forward of a busy week with the US presidential election and RBA fee resolution.

Ups and downs of AUD/USD

The Aussie had a bearish week amid financial studies from Australia and the US. The primary report from Australia revealed that inflation eased from 2.7% to 2.1% yearly, weighing on the Australian greenback. Nonetheless, underlying inflation remained a priority that saved fee minimize expectations low.

–Are you to study extra about foreign exchange choices buying and selling? Examine our detailed guide-

In the meantime, US information confirmed weaker-than-expected financial development within the third quarter. Inflation accelerated by zero.three% in September, maintaining Fed fee minimize expectations unchanged.

The final report for the week revealed weaker-than-expected job development. The financial system added 12,000 jobs, effectively under the forecast of 106,000. Nonetheless, the greenback quickly recovered with uncertainty forward of the US presidential election.

Subsequent week’s key occasions for AUD/USD

Subsequent week, merchants will watch the Reserve Financial institution of Australia and Federal Reserve coverage conferences. Economists consider the RBA will hold charges unchanged since inflation worries stay. On the similar time, they don’t anticipate any fee cuts in Australia this 12 months.

In the meantime, the US central financial institution is about to chop rates of interest by 25-bps. The most recent employment figures solidified bets for a fee minimize this November. Nonetheless, markets are nonetheless absorbing the brand new outlook for gradual fee cuts. There’s a probability that policymakers will sound hawkish. The US financial system has proven surprising resilience, pushing some to forecast just one minimize this 12 months. A hawkish tone may increase the greenback.

AUD/USD weekly technical forecast: Susceptible to check zero.6501 help

On the technical facet, the AUD/USD value is approaching the zero.6501 help stage. The bearish bias is robust as a result of the value trades far under the 22-SMA, and the RSI is close to the oversold area.

–Are you to study foreign exchange robots? Examine our detailed guide-

Bears have maintained a steep decline because the value fell under the SMA. Consequently, the value has did not make any important retracements to the SMA line. Nonetheless, the steep decline can not proceed and not using a pullback.

If the value reaches the zero.6501 help subsequent week, it would pause, permitting bulls to revisit the SMA resistance. If the SMA holds agency, the value will possible break under zero.6501 to retest the zero.6401 help stage. However, a break above the SMA would sign a shift in sentiment to bullish.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you’ll be able to afford to take the excessive threat of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!