Wabtec Product sales Lifting Stock Better…

Gross sales positive factors for Westinghouse Air Brake Applied Sciences Company (WAB), referred to as Wabtec, are driving its fill-up.

On this article:

-

WAB

+1.64%

WAB supplies locomotives, tools, techniques, and providers for the freight rail and passenger transit industries. The corporate affords locomotives powered by diesel-electric, battery, and liquid pure fuel, in addition to engines, electrical motors, propulsion techniques, marine merchandise, and mining merchandise to clients all over the world.

Analysts anticipate third- and fourth-quarter revenues at $2.64 billion and $2.61 billion, which signifies an enchancment of three.6% and three.2% from 2023, respectively. This triggered WAB administration to extend earnings steerage to $7.20-$7.50 per share and proceed its wholesome dividend program.

It’s no surprise WAB shares have gained 42% this 12 months – and so they might develop extra. Based mostly on MAPsignals information, buyers are betting closely on the ahead image of the inventory.

Huge Cash Loves Wabtec Shares

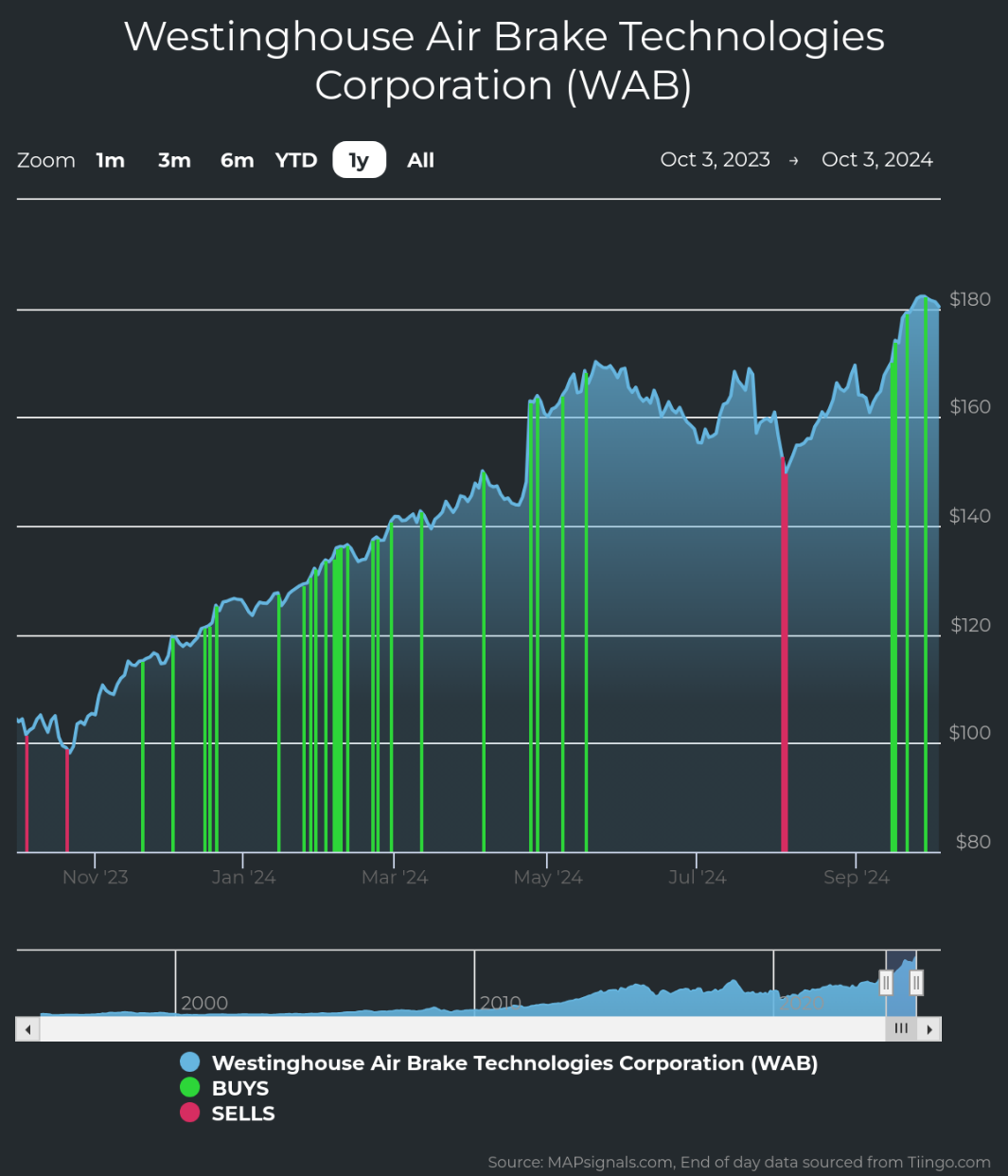

Institutional volumes reveal lots. Within the final 12 months, WAB has loved heavy Huge Cash shopping for, which we consider to be institutional accumulation.

Every of the inexperienced bars sign unusually massive volumes in WAB shares, pushing the inventory larger:

Supply: www.mapsignals.comLoads of industrials names are underneath accumulation proper now. However if you dive into the basics, there’s a particular tailwind occurring with Wabtec.

Wabtec Basic Evaluation

Institutional help coupled with a wholesome elementary backdrop makes this firm value investigating. As you possibly can see, WAB’s sturdy gross sales and EPS development has delivered the products:

- 1-year gross sales development price (+15.7%)

- Three-year EPS development price (+28.2%)

Supply: FactSet

The one-year EPS outlook is estimated to extend by +12.6%.

Now it is sensible why the inventory has been powering to new heights. WAB is gaining on account of its sturdy monetary efficiency.

Marrying nice fundamentals with our proprietary software program has discovered some huge successful shares over the long run.

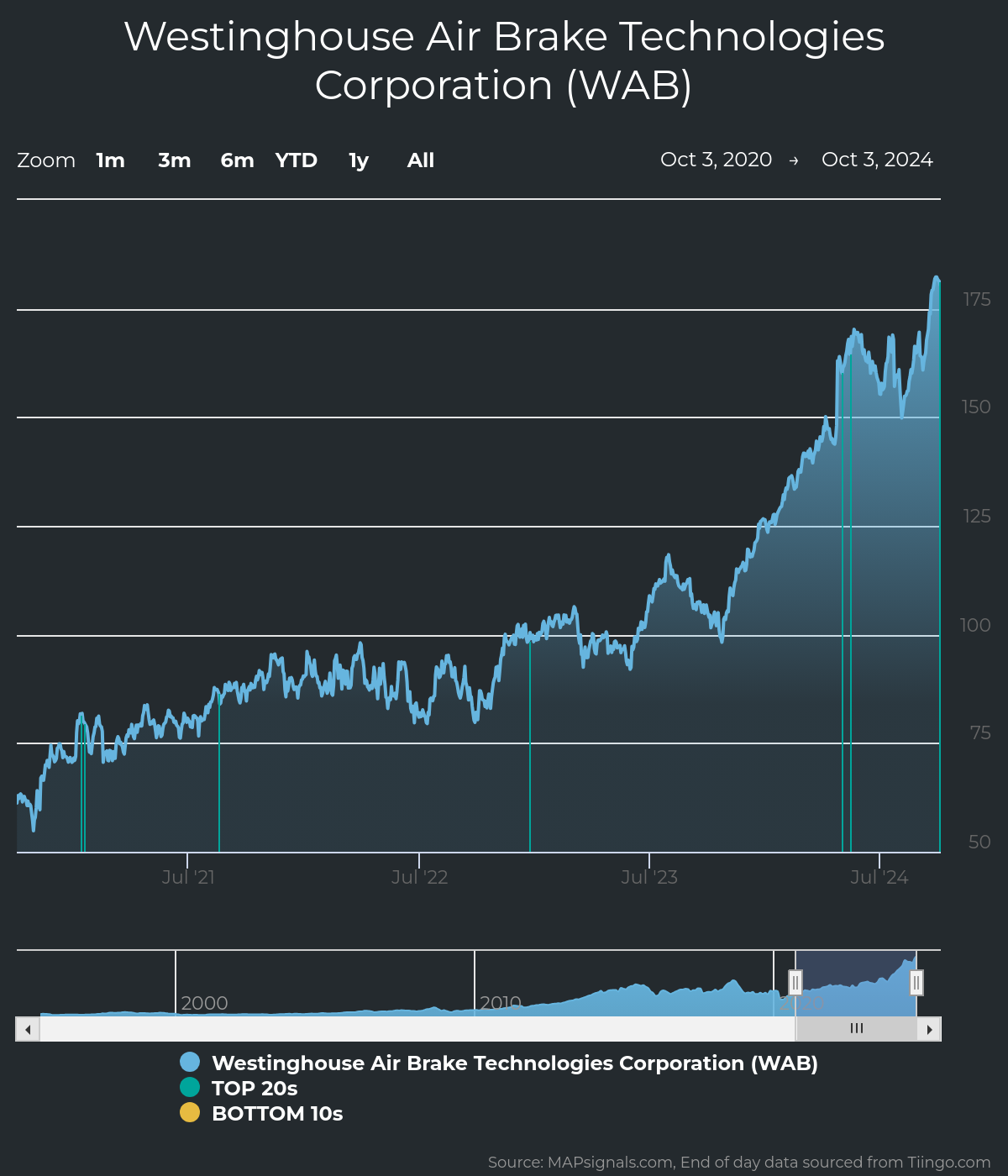

WAB has been a top-rated inventory at MAPsignals for a very long time. Which means the inventory has uncommon purchase strain and rising fundamentals. We have now a rating course of that showcases shares like this on a weekly foundation.

It’s made the uncommon Prime 20 report quite a few occasions over the past 4 years. The blue bars under present when WAB was a high choose…driving costs larger.

Supply: www.mapsignals.comMonitoring uncommon volumes reveals the ability of cash flows.

This can be a trait that the majority famous person shares exhibit. At the moment’s cash flows usually reveal tomorrow’s leaders.

Wabtec Value Prediction

The WAB rally isn’t new in any respect. Huge Cash shopping for within the shares is signaling to take discover. Given the historic positive factors in share worth and robust fundamentals, this inventory may very well be value a spot in a diversified portfolio.

Disclosure: the writer holds no place in WAB on the time of publication.

Leave a Reply

Want to join the discussion?Feel free to contribute!