AUD/USD Weekly Forecast: Impartial Bias Amid Delicate Coverage Shifts…

- The Fed and the Reserve Financial institution of Australia will stay cautious this 12 months.

- US unemployment claims unexpectedly fell, indicating a resilient labor market.

- Enterprise exercise within the US manufacturing sector improved.

The AUD/USD weekly forecast suggests little coverage easing within the US and Australia this 12 months, which might lead to a impartial bias.

Ups and downs of AUD/USD

The AUD/USD pair fluctuated this week and ended practically flat as merchants adjusted to the outlook for the brand new 12 months. The Fed and the Reserve Financial institution of Australia will stay cautious this 12 months. The Fed has projected solely two charge cuts, whereas the RBA may not begin slicing till the second quarter because of still-high inflation.

–Are you curious about studying extra about STP brokers? Test our detailed guide-

On the identical time, market contributors paid consideration to US knowledge, which confirmed that unemployment claims unexpectedly fell, indicating a resilient labor market. On the identical time, enterprise exercise within the manufacturing sector improved however remained in contraction.

Subsequent week’s key occasions for AUD/USD

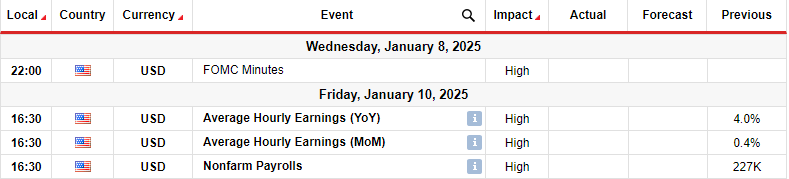

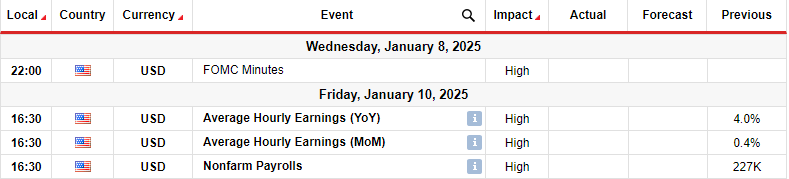

Subsequent week, traders will concentrate on US studies, together with FOMC minutes and month-to-month employment figures. The FOMC minutes will present how the Fed determined to chop rates of interest in December. On the identical time, it’ll include clues for future strikes. Through the December assembly, the Fed projected solely two charge cuts this 12 months, inflicting an enormous decline within the AUD/USD pair.

Furthermore, merchants will take note of the primary nonfarm payrolls report for the 12 months. The employment figures will proceed shaping the outlook for Fed charge cuts in 2025.

AUD/USD weekly technical forecast: Small-bodied candles sign exhaustion

On the technical facet, the AUD/USD value has steadied close to the zero.6202 assist stage. After a pointy fall, bears are exhibiting some exhaustion at this stage. The worth has maintained a bearish pattern because it broke beneath the 22-SMA, making decrease highs and lows. This sample has remained for lengthy, permitting AUD/USD to interrupt beneath main assist ranges.

–Are you curious about studying extra about foreign exchange bonuses? Test our detailed guide-

Nevertheless, after the current swing low, bears have proven some weak spot on the zero.6202 stage. The worth is making small-bodied candles, and the RSI has made a slight bullish divergence. If this performs out subsequent week, the value will seemingly rebound to the 22-SMA resistance.

Nevertheless, the bearish pattern will stay intact if the value stays beneath the SMA. Bears will search to make a brand new low beneath the zero.6202 assist. Then again, a break above the SMA would sign a shift in sentiment, permitting AUD/USD to retest the zero.6450 resistance.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you’ll be able to afford to take the excessive danger of dropping your cash

Leave a Reply

Want to join the discussion?Feel free to contribute!