AUD/USD Weekly Forecast: RBA Price Minimize Hypothesis Grows…

- The Fed saved charges unchanged on Wednesday.

- Trump emphasised his plans to impose tariffs on Canada and Mexico.

- Australia’s inflation got here in softer than anticipated.

The AUD/USD weekly forecast reveals draw back potential amid rising RBA fee lower bets and a stronger dollar.

Ups and downs of AUD/USD

The AUD/USD worth had a bearish week amid hawkish Fed indicators and elevated RBA fee lower expectations. The Fed saved charges unchanged on Wednesday and failed to provide any indication of near-term fee cuts. Consequently, the greenback strengthened. Furthermore, Trump emphasised his plans to impose tariffs on Canada and Mexico, boosting the dollar.

In the meantime, inflation figures in Australia revealed a smaller-than-expected zero.2% enhance, boosting bets for a Feb RBA fee lower, weighing on the Aussie.

Subsequent week’s key occasions for AUD/USD

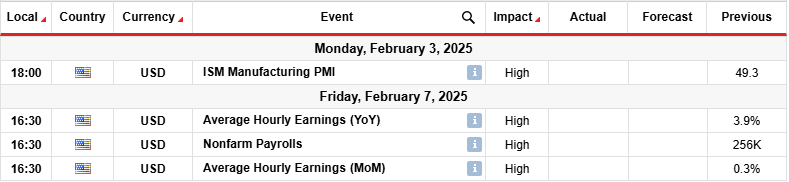

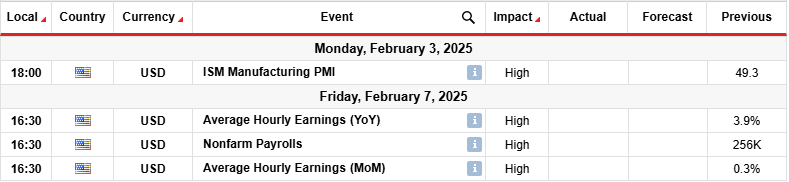

Subsequent week, the US will launch information on manufacturing enterprise exercise and month-to-month employment. The manufacturing PMI will present the well being of the economic system, shaping the outlook for US financial coverage. An surprising enhance in enterprise exercise will present resilience, whereas the other will present weak spot.

In the meantime, the US nonfarm payrolls will present job progress in January. The final report revealed an surprising enhance of 256,000 jobs, indicating a sturdy labor market. One other such report will enhance the greenback as it would slash Fed fee lower expectations. Alternatively, if employment eases, policymakers would possibly achieve extra confidence to decrease borrowing prices.

AUD/USD weekly technical forecast: Worth pauses within the zero.6151- zero.6300 vary

On the technical facet, the AUD/USD worth has entered a interval of consolidation between the zero.6151 assist and the zero.6300 resistance. The vary follows a robust downtrend that paused close to the zero.6151 assist stage. Right here, bears confirmed weak spot because the RSI made a slight bullish divergence. This consolidation is likely to be a pause within the downtrend or earlier than a reversal.

-In case you are concerned with figuring out about scalping foreign exchange brokers, then learn our tips to get started-

If it’s the first case, bears will problem the vary assist subsequent week. A break under this stage will permit AUD/USD to make a decrease low, persevering with the downtrend. Alternatively, if it’s a looming reversal, the value will break above the vary resistance to revisit the zero.6500 key stage.

Bulls will affirm a brand new bullish development when the value begins making larger highs and lows. Nevertheless, earlier than the value resumes a development, it’d stay in consolidation for some time.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you’ll be able to afford to take the excessive danger of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!