AUD/USD Weekly Forecast: US Information Dims Fed’s Transfer in Nov…

- The US CPI quantity got here in larger than anticipated, displaying elevated value stress.

- Wholesale inflation missed forecasts, weakening the greenback.

- The US will launch retail gross sales figures displaying shopper spending.

The AUD/USD weekly forecast exhibits a bearish tilt amid sturdy greenback as US knowledge diminishes hopes for a Fed’s price lower in November.

Ups and downs of AUD/USD

The Aussie had a bearish week with no main financial studies from Australia. In the meantime, the US launched a number of key studies that elevated the probability of a pause in the course of the November Fed assembly.

–Are you to be taught extra about ECN brokers? Examine our detailed guide-

The US CPI quantity got here in larger than anticipated, displaying elevated value stress. Though it eased price lower bets, policymakers are satisfied inflation will attain the two% goal. In the meantime, wholesale inflation missed forecasts, weakening the greenback.

One other report confirmed a higher-than-expected variety of jobless claims, indicating weak spot within the labor market. Market members additionally reviewed the FOMC assembly minutes, which confirmed a powerful dovish stance earlier than September’s sturdy employment figures.

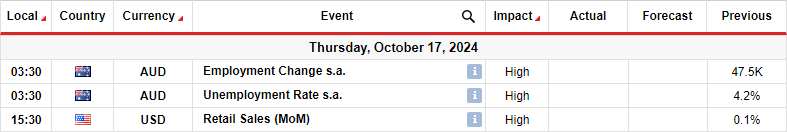

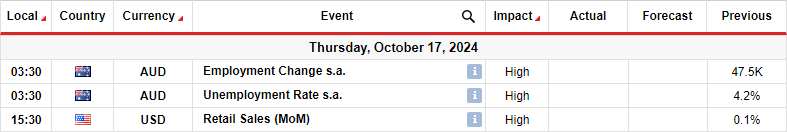

Subsequent week’s key occasions for AUD/USD

Subsequent week, Australia will launch employment figures that may impression the RBA’s coverage outlook. Australia’s labor market has proven resilience prior to now, resulting in a hawkish tone from RBA policymakers. Within the final report, there have been 47,500 jobs, with the unemployment price at four.2%.

This month’s report may present continued resilience or indicators of a cooling labor market. A sturdy report would increase the Aussie by pushing again the timing for the primary price lower. Then again, if there are indicators of weak spot, market members will enhance bets for a lower in December.

In the meantime, the US will launch retail gross sales figures displaying shopper spending. A soar in gross sales will point out sturdy shopper spending, lowering bets on a November Fed price lower. The other can be true.

AUD/USD weekly technical forecast: Bears breach channel boundaries

On the technical aspect, the AUD/USD value has damaged out of its bullish trendline in a pointy bearish transfer. Bulls gave up management when the value bought to the zero.6901 resistance degree. They confirmed this shift in management when the value broke under the 22-SMA and the channel assist line.

–Are you to be taught extra about getting cash in foreign exchange? Examine our detailed guide-

Nonetheless, the value is at the moment going through the zero.6700 assist degree. Subsequently, it’d bounce larger to retest the not too long ago damaged channel line earlier than both climbing or bouncing decrease to interrupt under zero.6700. A break under this degree would clear the trail to the following vital assist at zero.6501.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to contemplate whether or not you may afford to take the excessive threat of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!