EUR/USD Weekly Forecast: Buyers Pivot from US Markets…

- The EUR/USD weekly forecast reveals an investor migration from US property.

- Market volatility shot up after Trump carried out reciprocal tariffs.

- Knowledge revealed weaker-than-expected US client and wholesale inflation.

The EUR/USD weekly forecast is strongly bullish as buyers begin migrating from US property, supporting the euro.

Ups and downs of EUR/USD

The EUR/USD pair had a bullish week because the greenback collapsed amid financial uncertainty. In the meantime, the euro rallied along with safe-haven currencies just like the yen. Market volatility shot up after Trump carried out reciprocal tariffs on Wednesday. The transfer precipitated panic as buyers frightened in regards to the international financial system.

-Are you curious about studying in regards to the foreign exchange indicators? Click on right here for details-

Nonetheless, the greenback briefly rebounded when Trump paused these tariffs on most international locations. Nonetheless, the raging commerce wars between China and the US stored a lid on features. In the meantime, the euro rallied.

Moreover, information revealed weaker-than-expected US client and wholesale inflation. In consequence, Fed price lower expectations rose, additional weighing on the greenback.

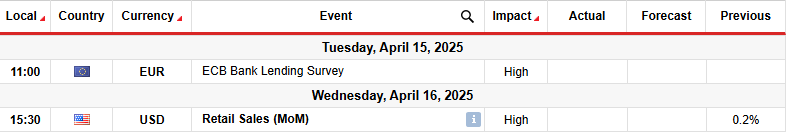

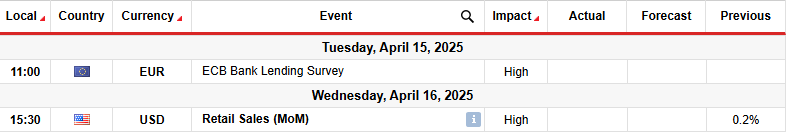

Subsequent week’s key occasions for EUR/USD

Subsequent week, market contributors will deal with the US retail gross sales report. The report will present the state of client spending and form the outlook for Fed price cuts. Within the earlier month, gross sales elevated by zero.2%. In March, economists forecast a extra vital improve of 1.four%. Softer-than-expected gross sales will sign weaker demand, placing strain on the Fed to chop rates of interest.

On the identical time, the European Central Financial institution will maintain its coverage assembly on Thursday. Economists anticipate the central financial institution to chop charges by 25-bps.

EUR/USD weekly technical forecast: Bulls break key 1.1204 resistance

On the technical facet, the EUR/USD value has had a robust bullish run, pushing the value previous the 1.1204 resistance stage. The rally additionally put the value far above the 22-SMA, exhibiting the bulls have a robust lead. In the meantime, the RSI has entered the overbought area, indicating strong bullish momentum.

–Are you curious about studying extra about British Commerce Platform Assessment? Verify our detailed guide-

Bulls took cost when the earlier downtrend paused close to the 1.0201 help stage. After taking cost, they stored the value above the 22-SMA, respecting it as a robust help. The worth has made a collection of upper highs and lows, exhibiting a developed bullish development.

Given the strong bullish bias, the value may quickly attain the 1.1603 key stage. Nonetheless, after such a steep swing from the SMA, bulls may have to relaxation. Subsequently, EUR/USD may pull again to retest the not too long ago damaged 1.1204 stage earlier than climbing greater.

Trying to commerce foreign exchange now? Make investments at eToro!

75% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you’ll be able to afford to take the excessive threat of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!