EUR/USD Weekly Forecast: Rebound Amid Stability in France…

- The fears of a looming French authorities collapse weighed on the euro.

- The greenback fell because of downbeat service enterprise exercise and unemployment claims information.

- The US unemployment charge rose to four.2% in November.

The EUR/USD weekly forecast reveals a restoration as French political turmoil eases and US unemployment surges.

Ups and downs of EUR/USD

The EUR/USD pair ended the week flat after fluctuating amid political developments in France and US financial information. The fears of a looming French authorities collapse weighed on the euro. Nevertheless, the forex recovered when the precise collapse did not have such a big affect. French authorities bonds rebounded, boosting sentiment.

-In case you are excited about Islamic foreign exchange brokers, examine our detailed guide-

In the meantime, the greenback initially fell because of downbeat service enterprise exercise and unemployment claims information. Nevertheless, the NFP report revealed a surge in job progress, quickly boating the greenback. In the meantime, the unemployment charge rose to four.2%, solidifying bets for a December Fed charge minimize.

Subsequent week’s key occasions for EUR/USD

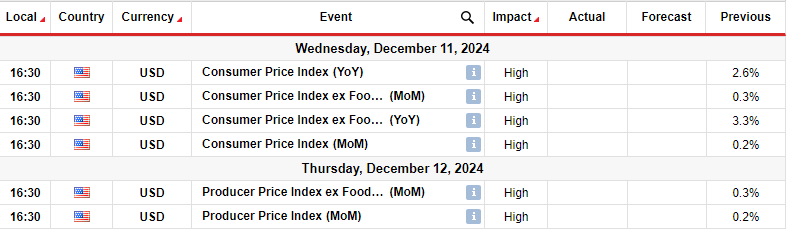

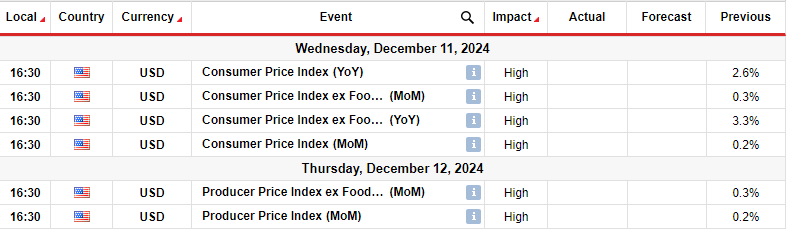

Subsequent week, merchants will watch US inflation figures for clues on Fed financial coverage. The Shopper Value Index is due on Wednesday. The final report confirmed inflation had stalled above the central financial institution’s goal. Nevertheless, December Fed charge minimize expectations remained regular since inflation met expectations. This time, if inflation is larger than anticipated, it should cut back the probability of a December charge minimize. Alternatively, if it meets forecasts or is available in under, rate-cut bets will surge, and the greenback will fall.

In the meantime, the Producer Value Index, due on Thursday, will present value pressures on the producer degree. The PPI is a number one indicator of future shopper costs. Subsequently, a drop will assist rate-cut bets, whereas a rise will increase the probability of a Fed pause.

EUR/USD weekly technical forecast: Rebound meets strong resistance zone

On the technical facet, the EUR/USD value has pulled again to retest the 22-SMA resistance after assembly the 1.zero400 assist. Though it punctured the SMA, the bearish bias stays intact. The RSI trades under 50, suggesting robust bearish momentum.

-In case you are excited about brokers with Nasdaq, examine our detailed guide-

Furthermore, bulls have punctured the SMA earlier than and did not reverse the pattern. This has created a resistance trendline barely above the SMA. A break above this trendline would sign a possible reversal. Nevertheless, if bears stay within the lead, the value will bounce decrease subsequent week to retest the 1.zero400 assist degree. A break under this degree would proceed the downtrend with a decrease low.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you’ll be able to afford to take the excessive danger of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!