EUR/USD Weekly Forecast: Upbeat Knowledge Relieves ECB Minimize Odds…

- The affect of Trump’s tariff threats light in the course of the week.

- Knowledge on Friday revealed a major enchancment in Eurozone enterprise exercise.

- Economists anticipate the US Central Financial institution to maintain rates of interest unchanged.

The EUR/USD weekly forecast suggests a rebound within the Eurozone economic system, lowering ECB price minimize expectations.

Ups and downs of EUR/USD

Because of upbeat Eurozone financial knowledge, the EUR/USD pair had a bullish week. On the similar time, the affect of Trump’s tariff threats light in the course of the week, permitting the forex to climb.

-Are you searching for automated buying and selling? Examine our detailed guide-

The US president has failed to offer clear steerage on tariffs since he took workplace. This decreased the specter of a weaker Eurozone economic system and decrease borrowing prices.

In the meantime, knowledge on Friday revealed a major enchancment in Eurozone enterprise exercise. France and Germany confirmed enhancements, easing stress on the European Central Financial institution to decrease borrowing prices.

Subsequent week’s key occasions for EUR/USD

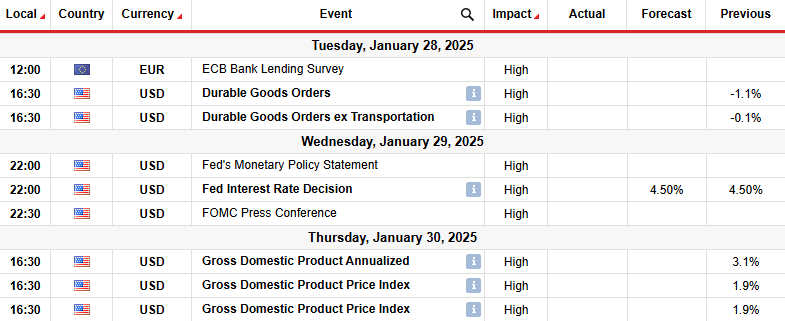

Subsequent week, merchants will give attention to financial stories from the US on sturdy items orders and gross home product. These will form the outlook for Fed price cuts this 12 months. Within the final two weeks, financial knowledge has proven a slight slowdown within the US economic system. If this development continues subsequent week, Fed price minimize expectations will enhance, and the greenback will fall. Then again, upbeat knowledge will decrease price minimize bets and enhance the buck.

In the meantime, economists anticipate the US Central Financial institution to maintain rates of interest unchanged in the course of the Wednesday assembly. Moreover, merchants will give attention to the tone in the course of the assembly.

EUR/USD weekly technical forecast: Bulls sighting 1.0603 resistance degree

On the technical facet, the EUR/USD worth has damaged above the 22-SMA to point a bullish sentiment shift. The break comes after the earlier downtrend paused on the 1.zero200 assist degree. The Bears confirmed exhaustion at this degree as they struggled to make vital swings from the 22-SMA. On the similar time, the RSI made a bullish divergence, indicating fading bearish momentum.

-Are you searching for foreign exchange robots? Examine our detailed guide-

The break above the SMA has allowed bulls to set their sights on the 1.0603 resistance degree. If the extent holds agency, the worth will pull again to revisit the SMA earlier than persevering with larger or dropping again to the 1.zero200 assist degree. A break above 1.0603 will permit EUR/USD to start out a brand new bullish development. Moreover, it can clear the trail to the 1.0926 resistance degree.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you may afford to take the excessive danger of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!