GBP/USD Weekly Forecast: BoE Charge Reduce Weighs on Pound…

- Republican candidate Donald Trump received the US presidential election.

- The Financial institution of England reduce rates of interest by 25-bps as anticipated.

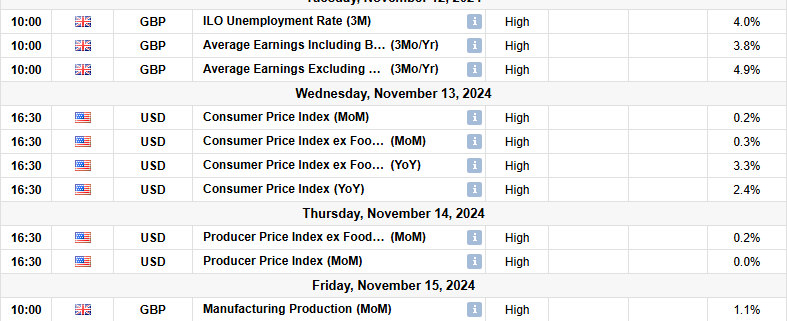

- Subsequent week, the US will launch shopper and wholesale inflation information.

The GBP/USD weekly forecast factors south amid a drop in BoE charge reduce expectations and a stronger greenback after Trump’s win.

Ups and downs of GBP/USD

After a unstable week, the pound ended on a bearish candle as market members absorbed the US election outcomes. After weeks of uncertainty, Republican candidate Donald Trump received the election. The win was bullish for the buck due to the expectation of upper tariffs and tax cuts throughout Trump’s presidency.

–Are you to study extra about low unfold foreign exchange brokers? Examine our detailed guide-

In the meantime, the Financial institution of England reduce rates of interest by 25-bps as anticipated. Nevertheless, the pound rallied as policymakers famous that the brand new price range would possible enhance inflation greater than earlier anticipated. Consequently, merchants diminished the anticipated charge cuts in 2025 from 4 to 3 or two.

Subsequent week’s key occasions for GBP/USD

Subsequent week, the UK will launch essential employment figures shaping the outlook for Financial institution of England charge cuts. Already, economists don’t count on one other BoE charge reduce this yr. Strong employment figures will possible push again the timing of the following charge reduce.

On the similar time, merchants will give attention to information on manufacturing manufacturing and gross home product that can present the state of the UK financial system. Latest information has demonstrated better-than-expected financial efficiency, which has lowered the anticipated charge cuts.

In the meantime, the US will launch shopper and wholesale inflation information that can decide the Fed’s future coverage strikes. If inflation is larger than forecast, the US central financial institution may hesitate to chop in December. Alternatively, charge reduce expectations will surge on cooler-than-expected figures.

GBP/USD weekly technical forecast: Bears goal the 1.2701 help

On the technical facet, the GBP/USD value has collapsed additional to make a brand new low under the 1.3000 key psychological stage. On the similar time, the worth trades under the 22-SMA with the RSI within the bearish area under 50.

–Are you curious about studying extra about AI buying and selling brokers? Examine our detailed guide-

After bulls paused on the 1.3400 resistance, bearish momentum surged, prompting the worth to interrupt under its help trendline and the 22-SMA. Subsequently, management shifted from bulls to bears and has remained that method. Sooner or later, bulls challenged the SMA and the 1.3000 however weren’t robust sufficient to take cost. Consequently, the approaching week may see GBP/USD reaching the 1.2701.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you’ll be able to afford to take the excessive danger of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!