Gold Shares and Gold – Trying on the Forest…

I wouldn’t say that it’s probably. Banning or limiting the export of supplies wanted for army purposes is one factor, and making use of the identical measure to the opposite commodities primarily based on that (particularly gold) is pre-mature.

There’s something referred to as the “contagion impact”, which implies that traders can panic as a result of one market appears associated to the opposite regardless that in actuality it isn’t. E.g. in the course of the disaster in Argentina a few years in the past, many different creating international locations began to expertise issues regardless of having no significant hyperlinks to the Argentinian economic system. Why? As a result of international traders incorrectly thought that there’s drawback “on the rising markets” and never simply in Argentina, and thus took capital out of different international locations as properly, thus inflicting financial issues.

Equally, a form of contagion is probably going taking part in out right here.

I don’t assume it should final lengthy, because it’s fairly clear that these are completely different markets – and it’s extra apparent than it’s been the case with the rising markets instance.

The choice clarification could possibly be that the martial legislation was launched in South Korea, however I don’t assume that the markets actually believed that it was something to essentially fear about. Within the remark to yesterday’s Gold Buying and selling Alert, I added:

Additionally, some might say that the martial legislation being enforced in South Korea is the rationale behind at present’s energy, however that’s one thing that might be more likely to set off a rally in gold (not gold shares) as gold serves because the safe-haven asset. So, the percentages are that it’s really information coming from China that’s primarily shifting the mining shares at present.

In different phrases, the dearth of gold’s motion referred to as it a bluff. Certainly, the market obtained it proper, because the martial legislation episode was short-lived.

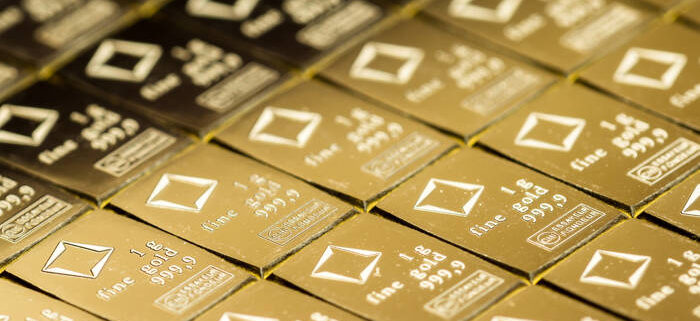

Whereas this probably (we’ll see the way it all performs out within the coming days) wasn’t a giant deal, let’s take into account that such black-swan occasions might occur, and that is why we’ve been suggesting retaining gold as a part of one’s insurance coverage capital (sure, it’s been there for years – it’s beneath the “Buying and selling” and “Funding” components within the abstract half), and what we simply noticed in South Korea may function a reminder to make it possible for this a part of the portfolio is taken care of.

In the event you’ve been neglecting it, this may be the right time to are likely to it. Retaining some gold in a single’s bodily possession is usually recommended as that’s the most secure type, however it may additionally be a terrific thought to think about retaining some gold in a single’s IRA for tax advantages. I’m no tax advisor, and that’s not funding or tax recommendation, however I do counsel getting a information on that and making a alternative after getting extra info.

Why am I saying that this correction is probably going near its finish? Identical to I acknowledged earlier than, silver is outperforming gold, identical to it did yesterday, however not like yesterday, miners are not sturdy.

Consequently, I don’t assume it will be appropriate to attribute at present’s positive aspects to the continuation of the “contagion impact” – if this was the case, miners could be sturdy at present as properly. If it’s not that, then it’s probably the common silver-outperforms-close-to-the-top impact.

Bullish Sentiment Might Be Deceptive

Additionally, you may be questioning – is the USD Index forming a head-and-shoulders high right here?

Leave a Reply

Want to join the discussion?Feel free to contribute!