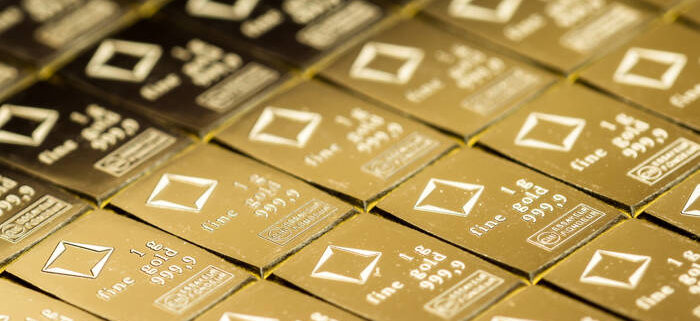

Gold (XAU) Silver (XAG) Day by day Forecast: Easing Insurance policies Enhance Metals, $2,643 and $29.50 in Focus…

Market analysts predict continued help for gold in 2025, citing larger central financial institution demand and a possible enhance from gradual Federal Reserve charge cuts. Some forecasts counsel gold might attain $three,000 per ounce as world financial easing and geopolitical dangers persist.

Silver’s Features Tempered by Financial Considerations

Silver (XAG/USD) is buying and selling at $28.91, reflecting minor losses however sustaining its upward trajectory from 2024, the place it gained almost 22%, its finest yr since 2020. Rising demand and easing world financial insurance policies underpinned the rally.

Nonetheless, the outlook for silver is clouded by potential financial headwinds, together with inflation considerations and the impression of President-elect Trump’s proposed tariffs on dwelling prices.

The Federal Reserve’s cautious stance on charge cuts in 2025 might additionally restrict silver’s upside potential.

The US Greenback stays subdued, buying and selling close to 108.00, as merchants assess the Federal Reserve’s restrained method to charge cuts. Treasury bond yields dropped by about 2%, including strain on the greenback.

The Fed’s newest steerage suggests fewer charge cuts in 2025, contributing to uncertainty in financial coverage underneath the incoming administration.

Leave a Reply

Want to join the discussion?Feel free to contribute!