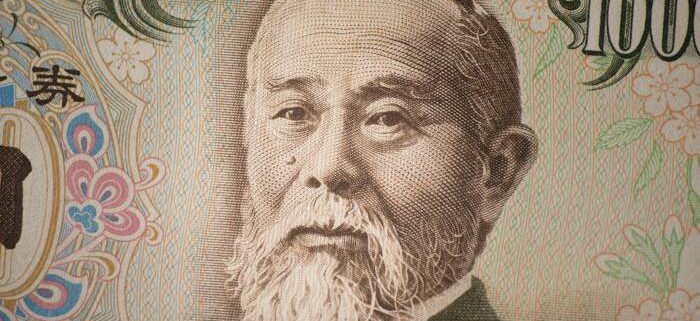

Japanese Yen and Australian Greenback Information: Japan Information and China in Focus…

A weaker labor market might gradual wage progress, cut back shopper spending, and ease inflation. Any pullback in shopper spending would additionally influence the Japanese economic system because it contributes over 50% to GDP. The Financial institution of Japan might delay a charge hike till Q1 2025, doubtlessly driving the USD/JPY to 150.

Japanese Financial Indicators Essential for the Financial institution of Japan

On October 10, Financial institution of Japan Deputy Governor Ryozo Himino emphasised the Financial institution’s charge selections will hinge on incoming knowledge. Weaker financial indicators, particularly associated to the labor market, inflation, and personal consumption, might stress the BoJ to carry off on any instant charge hike.

Japanese Yen Each day Chart

At present, the USD/JPY hovers close to the 200-day EMA, with key resistance at 150.

Hawkish FOMC member commentary, downplaying Fed charge cuts in November and December, might drive US greenback demand and push the USD/JPY via 150.

Conversely, help for aggressive charge cuts to help the US labor market might drop the USD/JPY towards the 148.529 help degree. The help degree has bolstered purchaser demand for the USD/JPY for seven consecutive classes.

Leave a Reply

Want to join the discussion?Feel free to contribute!