Nasdaq, Hold Seng, and Nikkei: Key Market Information and Technical Evaluation…

Regardless of a current correction from the resistance space, the Nasdaq might proceed to brush off the Fed’s hawkish stance. With over a 90% probability of a steady coverage charge on the subsequent Fed assembly, charge hike fears are easing. Nonetheless, the Nasdaq might nonetheless face strain from weaker manufacturing exercise and exterior dangers, resembling a authorities shutdown and declining European equities.

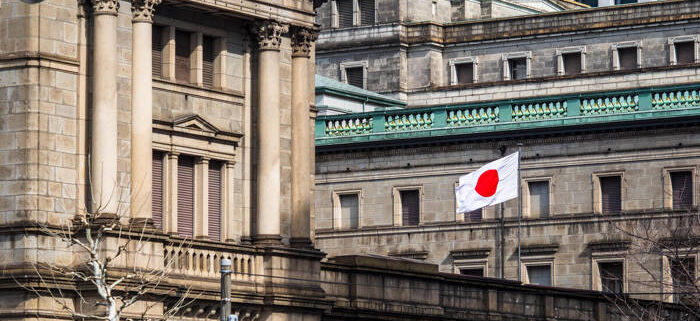

Alternatively, the Financial institution of Japan’s resolution to maintain rates of interest unchanged will doubtless help the Nikkei Index within the quick time period. The weaker yen boosts export-oriented firms, which dominate the index. Nonetheless, world inventory market strain from the US Federal Reserve’s cautious easing path might restrict positive aspects.

Nasdaq Index Evaluation – Ascending Channel

The NASDAQ index has been buying and selling inside an ascending channel for the previous two years, forming a bullish value motion. This ascending channel started when the 50-day SMA crossed above the 200-day SMA in March 2023. These SMAs constantly help the value after this crossover. The emergence of a double backside in August and September propelled the index towards the resistance of the ascending channel at 22,000. Nonetheless, after the Federal Reserve’s rate of interest cuts, the index corrected this resistance.

The rapid help degree is across the 50-day SMA at 20,800, with the following vital help on the neckline of the double backside at 20,000. The subsequent help after this lies within the ascending channel’s help at 18,400. These ranges shall be essential in figuring out the index’s capability to maintain its bullish trajectory.

Leave a Reply

Want to join the discussion?Feel free to contribute!