Pure Gasoline and Oil Forecast: Geopolitical Tensions Drive Mixed Sentiment in Vitality Markets…

- Geopolitical tensions weigh on oil costs as WTI crude falls to $76 amid profit-taking and market uncertainty.

- President Biden’s stance on avoiding direct strikes on Iran’s oil services eases some provide issues.

- Pure Gasoline reveals resilience, buying and selling above $2.94; bullish momentum builds with sturdy assist at $2.72.

On this article:

-

Pure Gasoline

+zero.39%

-

WTI Oil

-5.77%

-

Brent Oil

-5.75%

Market Overview

WTI crude oil futures dipped to round $76 per barrel on Tuesday, primarily attributable to profit-taking after current highs pushed by ongoing geopolitical tensions within the Center East. Traders are carefully watching potential escalations that would have an effect on oil provide routes.

Nevertheless, President Biden’s name for various methods over direct strikes on Iranian oil services has considerably alleviated issues.

Moreover, OPEC’s spare capability helps provide stability, countering fears of a extreme market disruption. In the meantime, demand issues linger, particularly in China, as markets search coverage route to maintain financial exercise and increase vitality consumption.

Pure Gasoline Worth Forecast

The technical indicators trace at a possible bullish development continuation, particularly because the 50-day Exponential Transferring Common (EMA) is positioned at $2.84, whereas the 200-day EMA sits at $2.68.

Rapid resistance ranges to observe are $2.77, adopted by $2.83 and $2.88, which might function key value targets if bullish momentum persists. Nevertheless, if costs fall beneath $2.72, it might set off a shift in sentiment, bringing fast assist ranges at $2.68 and $2.66 into focus.

WTI Oil Worth Forecast

Rapid assist sits at $74.37, adopted by $73.59 and $72.57, which might turn into key areas to observe if the promoting strain intensifies.

On the upside, breaking via $77.32 might propel costs to check greater resistance at $78.47 and $79.47. With the 50-day EMA at $73.87 and the 200-day EMA at $71.41, the technical indicators recommend a combined outlook, urging merchants to stay cautious.

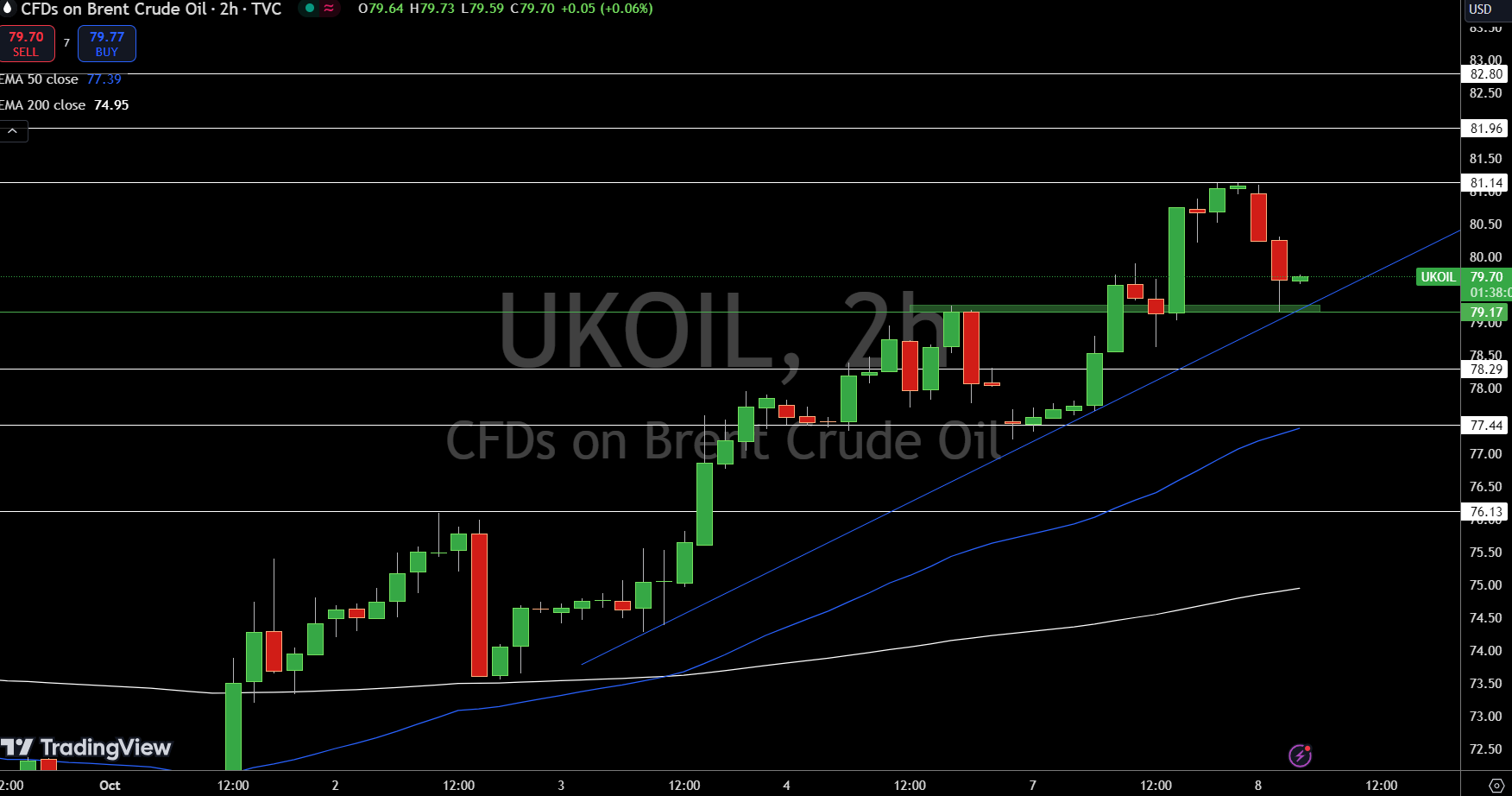

Brent Oil Worth Forecast

Past that, greater resistance ranges are marked at $81.96 and $82.80, which might pave the way in which for a stronger rally. On the draw back, assist at $78.29 and $77.44 might be crucial to observe if promoting strain intensifies.

With the 50-day EMA at $77.39 and the 200-day EMA at $74.95, UKOIL stays in a cautiously bullish development however wants to carry above $79.15 to maintain momentum.

Leave a Reply

Want to join the discussion?Feel free to contribute!