S&P 500 and Nasdaq Forecast: Geopolitics and Jobs Knowledge Gasoline Market Swings…

- Center East tensions and combined financial information drive U.S. inventory indices decrease, difficult merchants within the present international panorama.

- October buying and selling begins poorly as geopolitical dangers rise.

- Main U.S. indices monitor for weekly losses, diverging from robust year-to-date efficiency.

- vidia shares climb on CEO’s report of “insane” demand.

On this article:

-

WTI Oil

-Zero.39%

-

NVDA

+three.34%

-

US Wall St 30

+Zero.04%

-

S&P 500

-Zero.17%

U.S. Markets Open Decrease Amid Center East Tensions and Labor Market Issues

U.S. inventory indices began Thursday’s session on a downbeat observe as buyers grappled with rising geopolitical tensions and combined financial information. The market’s response highlights the continuing challenges confronted by merchants within the present international panorama.

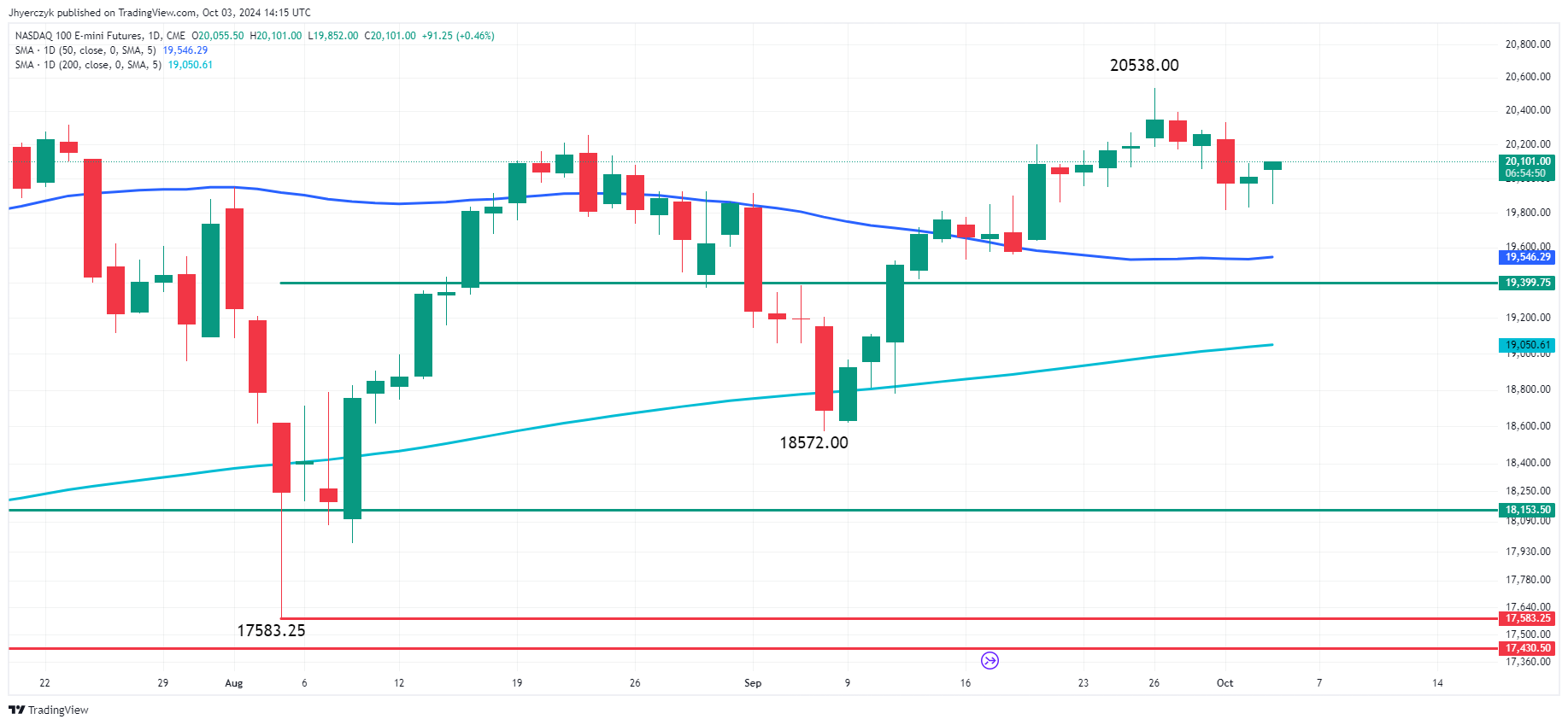

Day by day E-mini Nasdaq 100At 14:28 GMT, the Dow Jones Industrial Common is buying and selling 41987.51, down 209.01 or -Zero.50%. The S&P 500 Index is at 5692.36, down 17.18 or -Zero.30% and the Nasdaq is buying and selling 17884.01, down 41.11 or -Zero.23%.

Center East Battle Impacts Market Sentiment

Day by day Mild Crude Oil Futures

October buying and selling has begun on a bitter observe, with escalating tensions within the Center East dampening investor enthusiasm. The S&P 500, Dow Jones Industrial Common, and Nasdaq Composite are all monitoring for weekly losses, marking a shift from the robust efficiency seen within the first 9 months of the yr. The scenario has additionally pushed oil costs increased, with U.S. crude futures rising greater than 2% and bringing its week-to-date advance to over 5%.

Financial Knowledge Sends Combined Alerts

Weekly jobless claims got here in barely increased than economists’ forecasts, elevating issues concerning the labor market’s well being. Nevertheless, the companies sector confirmed resilience, with the ISM companies index reaching its highest stage since February 2023. The index reported that 54.9% of companies skilled enlargement in September, up from 51.9% in August. This optimistic information was partially offset by a contraction within the employment index, which dropped to 48.1%.

Company Information Impacts Particular person Shares

A number of firms noticed important inventory actions based mostly on latest developments:

Day by day Nvidia Company

- Nvidia shares rose over 1% after CEO Jensen Huang reported “insane” demand for its next-generation AI graphics processor.

- Levi Strauss plunged 12% following trimmed full-year income steering and disappointing fiscal third-quarter outcomes.

- Constellation Manufacturers noticed a slight enhance after beating earnings expectations however narrowly lacking income forecasts.

Tech Sector Reveals Resilience

Regardless of the general market weak point, the Nasdaq is placing in a combined efficiency, largely pushed by Nvidia’s robust efficiency. This highlights the continued investor curiosity in synthetic intelligence and know-how shares, even in a difficult market atmosphere.

Market Forecast

The short-term outlook for U.S. markets seems bearish, given the mix of geopolitical tensions, combined financial information, and cautious investor sentiment. Merchants ought to stay vigilant for potential volatility, significantly in vitality and know-how sectors.

The upcoming September payrolls report, due Friday morning, might present additional route for market individuals. On this unsure atmosphere, a defensive positioning could also be prudent, with a concentrate on high quality shares and sectors exhibiting relative energy.

Leave a Reply

Want to join the discussion?Feel free to contribute!