USD/CAD Weekly Forecast: Patrons Lead as Fed to Ease Progressively…

- The Fed would possibly reduce charges solely twice this 12 months.

- Knowledge this week confirmed an sudden drop in US unemployment claims.

- The loonie fell as markets anticipated tariffs on items from Canada.

The USD/CAD weekly forecast paints a bullish image for 2025, with gradual coverage easing within the US and a weaker financial system in Canada.

Ups and downs of USD/CAD

The USD/CAD worth had a bullish week because the greenback rose on the prospect of gradual coverage easing within the US. On the similar time, upbeat information from the US supported the buck. In the meantime, the loonie fell forward of Trump’s probably tariffs.

–Are you curious about studying extra about STP brokers? Examine our detailed guide-

The Fed would possibly reduce charges solely twice this 12 months, supporting the greenback. In the meantime, financial resilience can even increase the foreign money. Knowledge this week confirmed an sudden drop in unemployment claims. In the meantime, enterprise exercise within the manufacturing sector improved.

Alternatively, the loonie fell as markets anticipated tariffs on items from Canada underneath Trump’s new administration.

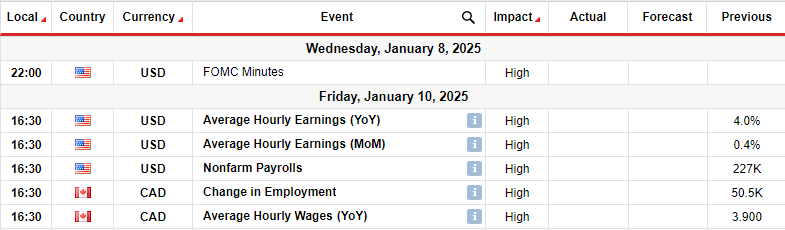

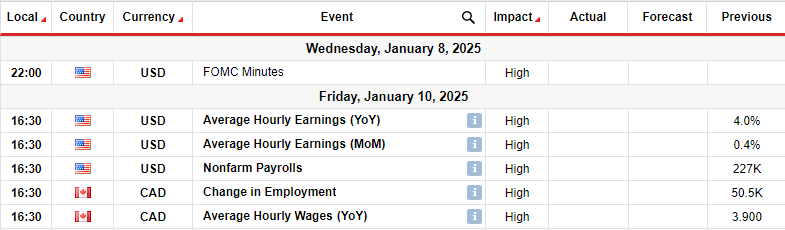

Subsequent week’s key occasions for USD/CAD

Subsequent week, the US will launch its first month-to-month employment report in 2025. On the similar time, market contributors will watch the FOMC assembly minutes. In the meantime, Canada will solely launch its month-to-month employment report.

The US nonfarm payrolls report will present the state of employment in December. Quicker-than-expected job development will help the outlook for few Fed fee cuts this 12 months. Alternatively, a downbeat report would possibly improve rate-cut expectations.

Equally, Canada’s employment report will assist form the outlook for Financial institution of Canada fee cuts in 2025.

USD/CAD weekly technical forecast: Bulls problem 1.4450 resistance

On the technical aspect, the USD/CAD worth has paused its uptrend on the 1.4450 resistance degree. The bullish bias is powerful for the reason that worth trades above the 22-SMA with the RSI within the overbought area.

–Are you curious about studying extra about foreign exchange bonuses? Examine our detailed guide-

The uptrend has remained sturdy for the reason that worth broke above the 22-SMA. Bulls have revered this SMA as help, pushing costs off it to make new highs. On the similar time, the RSI has traded above 50 in bullish territory, reaching the overbought area a number of occasions.

If this momentum continues subsequent week, the worth will break above the 1.4450 degree, making a better excessive within the uptrend. Nevertheless, earlier than this occurs, the worth would possibly pull again to retest the 22-SMA as help. If it bounces increased, the uptrend will proceed. Alternatively, if it breaks beneath the SMA, it’ll sign a shift in sentiment to bearish.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you’ll be able to afford to take the excessive danger of shedding your cash

Leave a Reply

Want to join the discussion?Feel free to contribute!