USD/CAD Weekly Forecast: Canada’s Financial Outlook Brightens as Tariff Dangers Fade…

- The USD/CAD weekly forecast signifies an bettering outlook for Canada’s financial system.

- The commerce warfare between the 2 largest economies weighed on the greenback.

- Downbeat US inflation figures elevated Fed price minimize bets.

The USD/CAD weekly forecast signifies an bettering outlook for Canada’s financial system, which escaped Trump’s reciprocal tariffs.

Ups and downs of USD/CAD

The USD/CAD pair collapsed this week as Trump’s tariffs prompted a widespread sell-off in US belongings. The greenback weakened after Trump imposed a reciprocal tariff on many of the US’s buying and selling companions. Analysts moved to foretell a probable international recession that despatched most buyers to safe-haven currencies. The loonie gained as a result of Canada once more escaped new US tariffs, easing worries about Canada’s financial system.

-Are you curious about studying concerning the foreign exchange indicators? Click on right here for details-

Though Trump paused these tariffs for ninety days, these on China elevated. The commerce warfare between the 2 largest economies weighed on the greenback. Furthermore, downbeat US inflation figures elevated Fed price minimize bets.

Subsequent week’s key occasions for USD/CAD

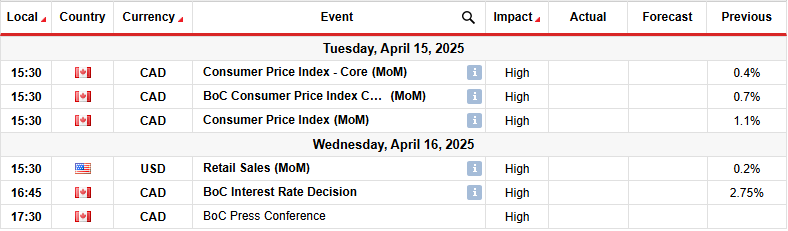

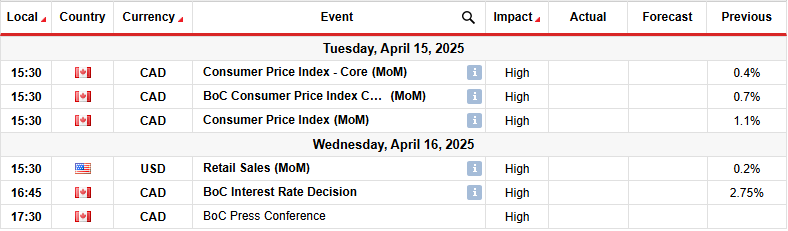

Subsequent week, merchants will deal with Canada’s inflation figures. After a earlier studying of 1.1%, economists count on inflation to ease to zero.7%. An sudden surge would decrease BoC price minimize expectations. In the meantime, smooth figures would enhance rate-cut bets, hurting the loonie.

Moreover, analysts count on the Financial institution of Canada to maintain rates of interest unchanged throughout Wednesday’s assembly. In the meantime, the US will launch its retail gross sales report, which will present the state of shopper spending and demand.

USD/CAD weekly technical forecast: Sharp might pause on the 1.3802 help

On the technical aspect, the USD/CAD value has lastly damaged out of its consolidation. For a very long time, it was trapped between the 1.4200 help and the 1.4502 resistance ranges. The earlier bullish pattern paused, and the worth began shifting sideways with no clear course. In the meantime, the RSI was declining, exhibiting bulls have been dropping momentum.

–Are you curious about studying extra about British Commerce Platform Evaluate? Verify our detailed guide-

Ultimately, the worth broke beneath the vary, supported by a robust candle. It pulled again to retest the SMA earlier than collapsing in a steep transfer. Bears are focusing on the following hurdle on the 1.3802 help degree. The decline may pause briefly at this degree because the SMA catches up.

Nevertheless, the bearish bias is robust, with the RSI heading for the oversold area. Due to this fact, bears may ultimately break beneath 1.3802. Such an end result would clear the trail to the 1.3400 key help. The downtrend will proceed so long as the worth trades beneath the SMA, with the RSI underneath 50.

Trying to commerce foreign exchange now? Make investments at eToro!

75% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to take into account whether or not you’ll be able to afford to take the excessive threat of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!