USD/CAD Weekly Forecast: Greenback Dips on Trump’s Mushy Stance…

- Information from Canada revealed that inflation eased to 2.four% yearly.

- Canada’s retail gross sales made no change in November.

- Subsequent week, buyers will deal with coverage conferences in Canada and the US.

The USD/CAD weekly forecast exhibits aid over Trump’s delicate method to tariffs supporting the Canadian greenback.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week as market members targeted on financial information and US political developments. Information from Canada revealed that inflation eased to 2.four% yearly. In the meantime, retail gross sales made no change in November. Nonetheless, the Canadian greenback gained on aid that Trump was not too aggressive in imposing tariffs.

-Are you in search of automated buying and selling? Verify our detailed guide-

Alternatively, the greenback eased on Friday after information revealed a big drop in service sector enterprise exercise within the US. Downbeat information will increase expectations for Fed price cuts.

Subsequent week’s key occasions for USD/CAD

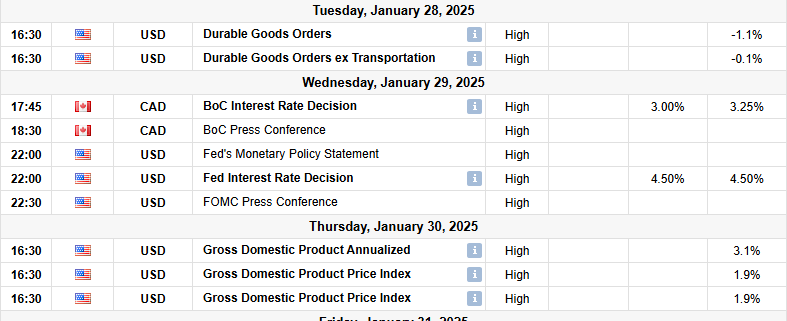

Subsequent week, market members will deal with information from the US, together with sturdy items orders and GDP. Furthermore, the Fed will maintain its coverage assembly on Wednesday. The Financial institution of Canada can even maintain its coverage assembly on Wednesday. In the meantime, GDP information from Canada on Friday will affect the Canadian greenback.

The GDP studies from Canada and the US will present the state of those two economies, shaping the outlook for financial coverage. The Fed will doubtless preserve charges unchanged. Nevertheless, merchants will deal with messaging for future strikes. In the meantime, market members count on the BoC to chop charges by 25-bps.

USD/CAD weekly technical forecast: Bears gear up for a pattern reversal

On the technical aspect, the USD/CAD worth has paused close to the 1.4450 resistance stage, the place the worth has began chopping by means of the 22-SMA. Earlier than the pause, it was on a stable bullish pattern, respecting the SMA as help.

-Are you in search of foreign exchange robots? Verify our detailed guide-

On the identical time, bulls stored making larger highs and lows till the worth bought to the 1.4450 stage. Right here, bears confirmed power by making engulfing candlestick patterns. Furthermore, though the worth made barely larger highs, the RSI made decrease ones, indicating a bearish divergence.

The worth at the moment trades under the 22-SMA, indicating a bearish shift in sentiment. If bears preserve this course subsequent week, the worth may drop to the following help at 1.4003. Such an end result would verify a bearish reversal. Nevertheless, the worth will nonetheless need to make decrease lows and highs to point out a brand new downtrend.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to contemplate whether or not you possibly can afford to take the excessive threat of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!