USD/CAD Weekly Forecast: Gaining Forward of Main BoC Minimize…

- Merchants elevated the chance of a large Financial institution of Canada charge lower in December.

- Canada’s unemployment charge jumped from 6.5% to six.eight%.

- US job progress surged, with over 200,000 jobs in November.

The USD/CAD weekly forecast suggests additional upside for the pair as markets await one other large BoC charge lower.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week, the place the Canadian greenback misplaced floor towards the US greenback. The loonie was weak as merchants elevated the chance of a large Financial institution of Canada charge lower in December. At first, this was on account of a downbeat GDP report. Furthermore, Canada launched a combined employment report on Friday. Markets centered on the unemployment charge, which jumped from 6.5% to six.eight%.

-If you’re desirous about Islamic foreign exchange brokers, examine our detailed guide-

In the meantime, the buck fared higher regardless of combined financial figures. Enterprise exercise within the US companies sector fell. Alternatively, job progress surged, with over 200,000 jobs in November. Nonetheless, unemployment additionally elevated to four.2%, solidifying the prospect of a December Fed charge lower.

Subsequent week’s key occasions for USD/CAD

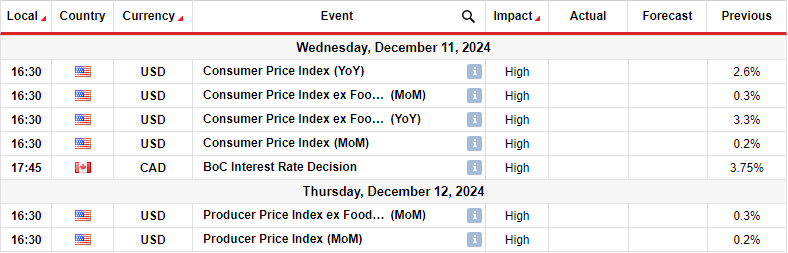

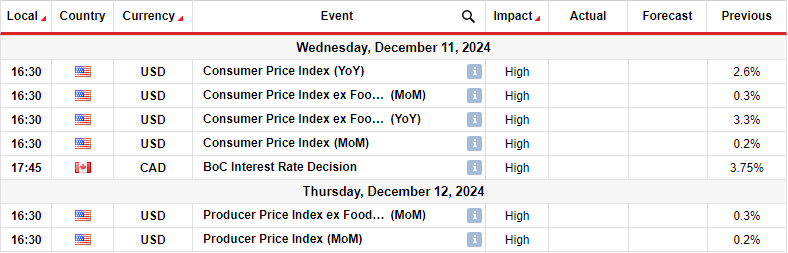

Subsequent week, market contributors will give attention to US shopper and producer inflation knowledge. In the meantime, the Financial institution of Canada will maintain its coverage assembly on Wednesday. The US inflation figures will form the outlook for the December Fed assembly.

Final month, inflation elevated in step with expectations, indicating a pause within the downtrend. An upbeat report this week will enhance the chance of a Fed pause in December. Alternatively, a downbeat report will solidify rate-cut bets, weighing on the greenback.

In the meantime, the Financial institution of Canada may implement one other super-sized charge lower subsequent week. Canada’s economic system has considerably slowed, placing stress on the central financial institution to chop rates of interest. A 50-bps lower will probably weaken the loonie.

USD/CAD weekly technical forecast: Bulls check 1.4152 resistance

On the technical aspect, the USD/CAD value made a pointy transfer from the 22-SMA to the 1.4152 resistance degree. Because of this, the worth has moved effectively above the SMA, exhibiting bulls are within the lead. On the similar time, the RSI, which had initially proven fading momentum, broke above its resistance line and is approaching the overbought area.

-If you’re desirous about brokers with Nasdaq, examine our detailed guide-

Nonetheless, bulls are nonetheless dealing with a robust hurdle on the 1.4152 degree. A break above this degree will make the next excessive, persevering with the bullish development. Alternatively, if the extent holds agency, the worth may bounce decrease subsequent week to retest the 22-SMA assist.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you may afford to take the excessive threat of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!